According to Chairman Liu Young-way, Foxconn, Apple’s primary iPhone assembler and the world’s leading contract electronics manufacturer, anticipates a business performance “slightly better” than last year.

Despite a strong showing last year, Foxconn faced a first-quarter write-off related to its stake in Sharp Corp. However, the company remains optimistic about 2024, even as it grapples with a shortage of chips for AI servers.

AI Server Demand and Global Economic Uncertainty:

While Foxconn expects robust demand for artificial intelligence (AI) servers, Chairman Liu acknowledges that global economic uncertainty stemming from geopolitical issues may impact consumer product demand.

Liu highlights the complexity of the market dynamics, stating, “One (market segment) will be good, but very many others – uh-oh.”

Apple’s Influence on Foxconn’s Outlook:

Foxconn’s outlook is influenced by its close relationship with Apple, as the tech giant recently forecasted a decline in iPhone sales.

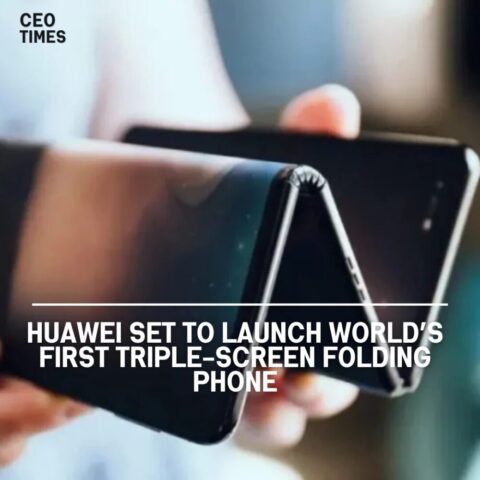

The Chinese market’s preference for foldable phones and alternatives from competitors like Huawei, utilizing locally-made chips, challenges Apple’s regional dominance.

Chairman Liu notes that the production capacity for chips for servers is constrained, even with strong demand. He suggests the need for new factories to meet the rising demand for these critical components.

The global chip shortage continues to impact various industries, affecting production capabilities across the technology sector.

Foxconn’s Q4 Earnings and Future Updates:

Foxconn, formally known as Hon Hai Precision Industry Co Ltd, is set to report its fourth-quarter earnings next month, providing insights into its financial performance and an update on its outlook for 2024.

The company’s January sales data, to be released on Monday, will be closely monitored for additional indicators of its current trajectory.

Stock Performance and Market Trends:

Foxconn’s shares have experienced a 2.4% decline early this year, contrasting with a 0.7% gain for the broader market.

The company’s stock performance reflects its unique challenges and broader market trends impacting the electronics manufacturing sector.