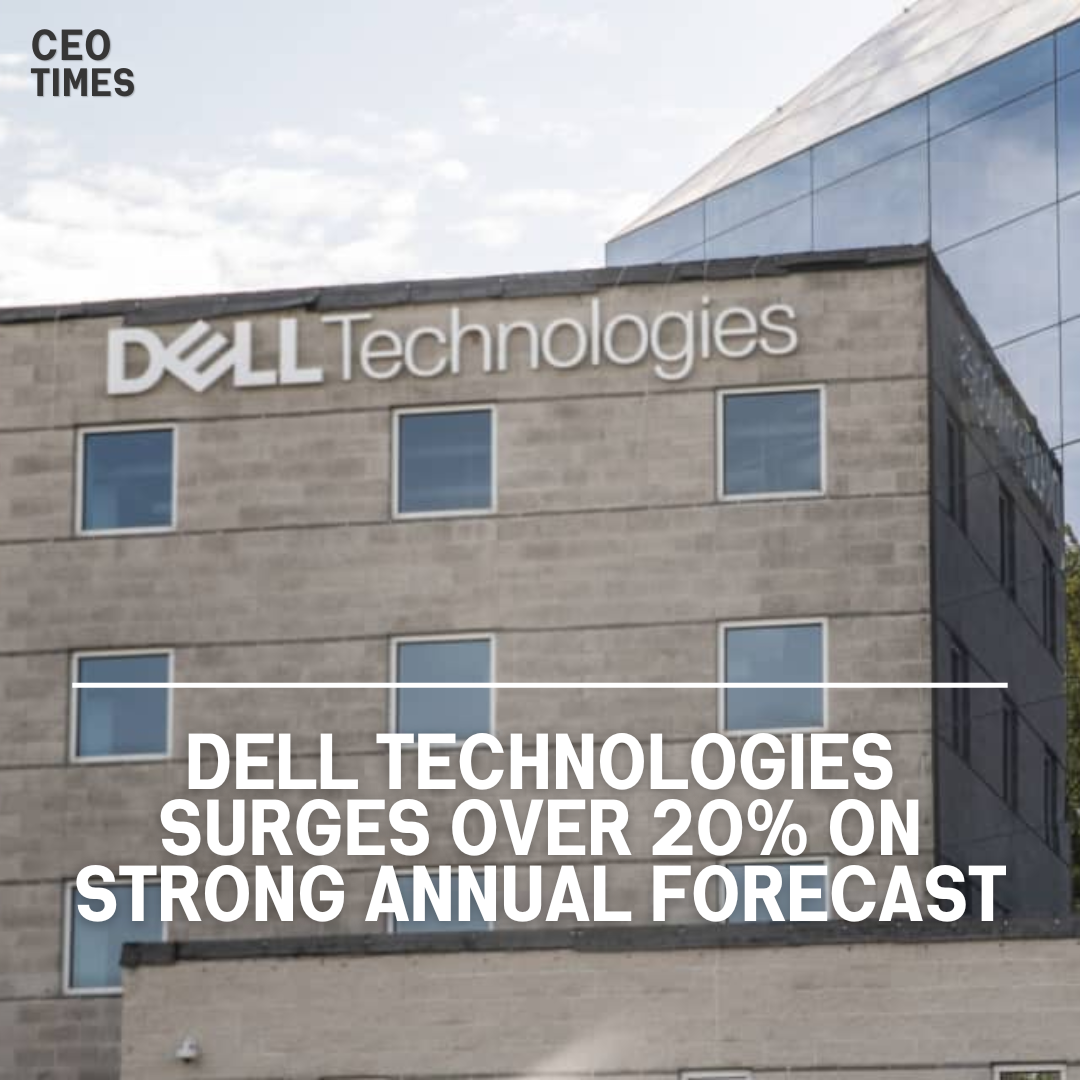

Dell Technologies experienced a remarkable surge of over 20% in its shares on Friday following the release of an annual forecast that surpassed Wall Street expectations, signaling heightened demand for AI-related technology.

Market Response and Potential Capitalization:

If the current level is sustained, the tech equipment maker’s shares soared to $116.6, potentially adding over $15 billion to its market capitalization. This significant uptick marks the second consecutive day of approximately 20% gains, following robust quarterly results.

Dell reported a notable 40% sequential increase in orders for its AI-optimized servers in the fourth quarter, with the backlog nearly doubling, as highlighted by COO Jeff Clarke. This performance underscores the escalating adoption of AI technology and its tangible impact on enterprise technology vendors.

Revenue Growth of Dell Technologies and Brokerage Response:

In the fourth quarter, servers and networking revenue reached $4.9 billion, primarily driven by AI-optimized servers. Several brokerages raised their price targets in response to Dell’s strong performance, with most analysts holding a “buy” or higher rating, reflecting confidence in the company’s trajectory.

Also Read: Apple Faces Security Concerns as It Adapts iPhones to EU Tech Rules

Commentary and Market Comparison:

Analysts at Bernstein noted that Dell’s AI business demonstrated significant progress while highlighting similarities in market sentiment with PC and enterprise technology vendor HP, whose sales declined for the seventh consecutive quarter.

Financial Performance and Outlook:

Dell’s revenue for the fourth quarter slightly surpassed expectations at $22.32 billion, with an adjusted per-share profit of $2.20 exceeding estimates.

According to analysts at Evercore ISI, the company’s fiscal year ending January 2025 is projected to generate revenue between $91 billion and $95 billion, reflecting strong AI trends and improved performance across servers, storage, and PCs.