Big Tech races ahead with record AI investments as trade war tariffs raise costs but fail to slow America’s pursuit of AI dominance.

If there is one rare point of alignment between the White House, Wall Street, and Silicon Valley, it is that artificial intelligence is no longer optional — it is a top national and corporate priority.

From Washington’s AI action plan to Wall Street’s bullish bets on AI stocks, and Big Tech’s billion-dollar data center investments, the message is clear: the United States views leadership in artificial intelligence as an existential necessity.

The AI Boom Overshadows Tariff Worries

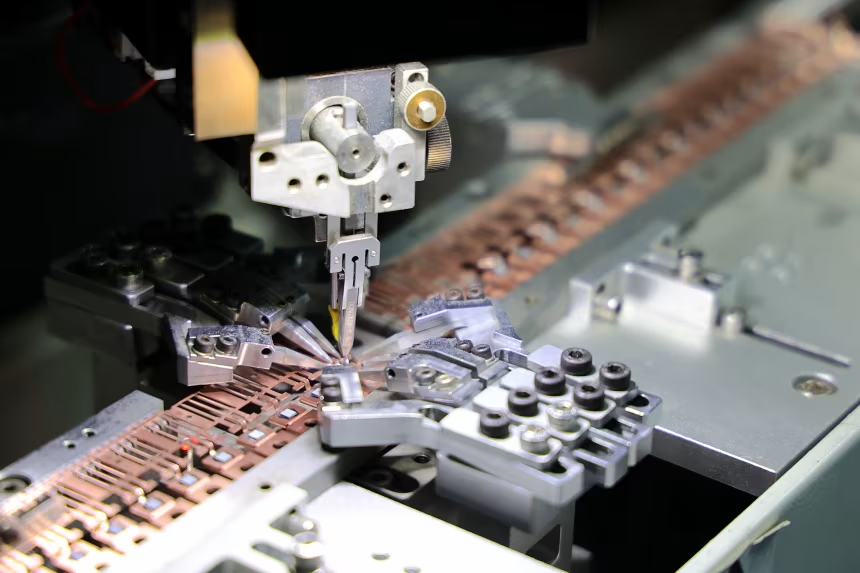

President Donald Trump’s ongoing trade war has introduced uncertainty around costs. With 50% tariffs on copper and threats of a 100% levy on semiconductor imports, the raw materials crucial for powering AI infrastructure could become significantly more expensive.

Yet for Silicon Valley, tariffs are a secondary concern. Analysts argue that falling behind in the global AI race represents a far greater threat than higher construction or material costs.

“Cost, if you have enough money, is not the most important variable when you’re told it’s an existential threat,” said Dallas Dolen, US technology and media lead at PwC.

Billions Flow Into AI Infrastructure

Earnings reports from Meta, Microsoft, and Alphabet highlight how aggressively tech giants are spending on AI:

- Meta spent $17 billion in capital expenditures last quarter, fueling infrastructure for AI services and boosting earnings per share by 38%. Its stock is up 30% year to date.

- Microsoft allocated $24.2 billion in capex and pledged another $30 billion, becoming the second company after Nvidia to hit a $4 trillion valuation.

- Alphabet raised its 2025 capex to $85 billion, citing soaring demand for Google Cloud products, which power “nearly all gen AI unicorns.”

This surge in spending is only the beginning. Goldman Sachs estimates that global data center energy demand will rise 50% by 2027 and 165% by 2030, driven largely by AI.

Tariffs Could Raise Costs — But Not Halt Progress

Trade policies remain a complicating factor. PwC estimates tariffs could increase data center construction costs by 5–7%, while the National Association of Manufacturers cites raw material prices as a top challenge.

For tech giants, these costs are manageable. “Demand is so strong,” said Michelle Brophy of AlphaSense, that companies like Microsoft, Amazon, and Alphabet will simply absorb them. Smaller startups, however, face tougher choices as long-term infrastructure bets clash with investors’ expectations of fast returns.

The U.S. Push for AI Dominance

Despite tariffs, Trump has shown flexibility with Big Tech. Companies committing to U.S. manufacturing — like Nvidia and TSMC — are likely to receive tariff exemptions. Recent negotiations even allowed Nvidia and AMD to sell chips to China in exchange for a government revenue share.

The White House’s AI action plan further underscores the urgency, with proposals to fast-track permits for data centers and semiconductor plants. Already, the U.S. leads the world in data center capacity, home to tech titans like Amazon, Microsoft, and Google.

A Global Race America Can’t Afford to Lose

For Silicon Valley, the calculus is simple: tariffs may raise costs, but losing leadership in artificial intelligence would be catastrophic.

As Wedbush analyst Dan Ives put it, “We have barely scratched the surface of this 4th Industrial Revolution now playing out around the world led by Nvidia, Microsoft, Palantir, Meta, Alphabet, and Amazon.”

In a world where AI determines competitiveness, the stakes are too high for America to slow down — tariffs or not.