Expiring U.S. EV Tax Credit Fuels Surge, But Analysts Warn of Slower Sales Ahead

Tesla set a new sales record in the third quarter of 2025, delivering 497,099 vehicles worldwide between July and September, a 29% jump from the previous quarter and a 7% increase year-over-year. The surge, driven largely by U.S. buyers rushing to secure purchases before a $7,500 federal EV tax credit expired on September 30, briefly propelled CEO Elon Musk’s net worth above the half-trillion-dollar mark.

The milestone makes this Tesla’s first year-over-year quarterly sales gain in 2025. However, the outlook is less certain. Experts warn that demand could taper off in the coming months, with the Biden-era EV tax credit eliminated as part of President Donald Trump’s broader spending and tax bill. Despite the strong third quarter, Tesla’s year-to-date sales remain down 6% compared with the same period last year.

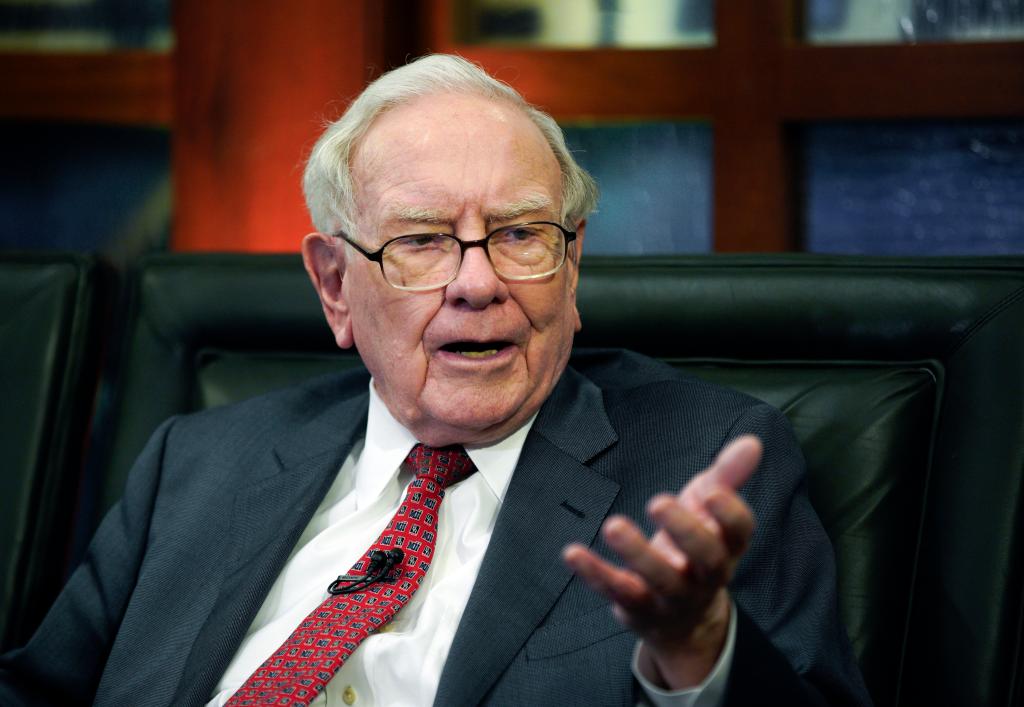

Musk Crosses Historic Wealth Threshold — Briefly

The record sales briefly lifted Tesla’s stock by about 2% in early Thursday trading, edging toward its all-time high from December 2024. This surge pushed Musk’s net worth to $500.8 billion, according to Forbes’ real-time billionaire tracker, making him the first person to cross the half-trillion-dollar wealth mark. But by the afternoon, shares slipped 4%, pulling Musk’s fortune back down to $490 billion.

EV Market Heats Up as Rivals Gain Ground

Tesla’s record quarter reflects a broader pre-credit surge across the EV industry. General Motors reported that its U.S. EV sales more than doubled during the quarter, while Ford posted a 30% gain — both setting records for the automakers. Hyundai also doubled its U.S. EV sales, though it later announced significant price cuts averaging $9,155 on its IONIQ 5 to stay competitive. Industry experts expect further price reductions across the sector as automakers seek to counter the renewed appeal of gasoline and hybrid models.

Still, Tesla’s grip on the EV market is loosening. Registration data reveals a steady loss of global market share, with Chinese automakers — particularly BYD — accelerating growth in both Europe and their domestic market. BYD reported a 31% year-over-year increase in EV passenger car sales in the third quarter, totaling 1.6 million vehicles so far this year, compared with Tesla’s 1.2 million. This positions BYD to overtake Tesla as the world’s largest EV maker despite having no U.S. sales presence.

Challenges Ahead for Tesla

Tesla’s struggles are not purely competitive. Musk himself has become a polarizing figure, with his political activities drawing criticism and sparking protests in both the United States and Europe. Combined with intensifying competition from established automakers and low-cost Chinese rivals, Tesla faces mounting pressure to defend its market dominance.

While the third-quarter results mark an important victory and a historic moment for Musk’s personal wealth, the sustainability of Tesla’s momentum remains in question. With subsidies expiring, rivals cutting prices, and market share slipping, the coming quarters will test whether Tesla can retain its lead in the global EV race.