While AI fuels record highs and innovation excitement, Solomon cautions that not all tech investments will deliver, signaling a market correction in the next 12–24 months.

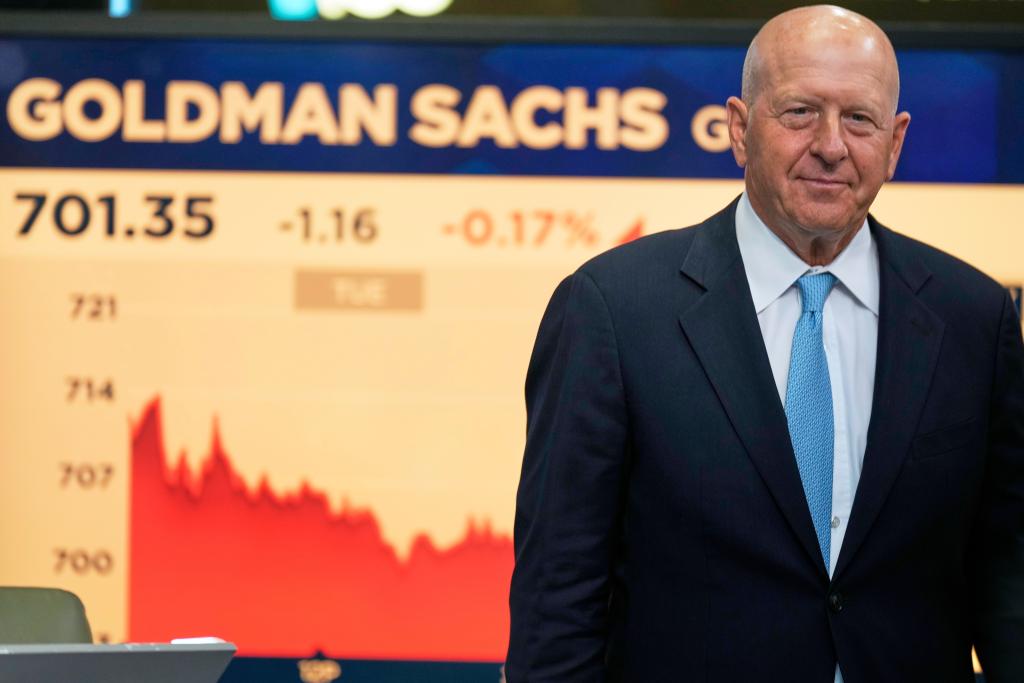

Goldman Sachs CEO David Solomon has sounded a note of caution to investors riding the wave of artificial intelligence-driven enthusiasm. Speaking at Italian Tech Week in Turin, Italy, on Friday, Solomon warned that the recent surge in AI investments may be overextended, with stock markets poised for a potential “drawdown” in the coming year or two.

Major U.S. stock indexes have repeatedly hit record highs this year, fueled by optimism over AI technologies and massive capital injections into the sector. Companies such as Microsoft, Alphabet, Palantir, and Nvidia have announced multi-billion-dollar AI investments, driving institutional and retail interest. However, Solomon noted that enthusiasm may be outpacing reality.

“You’re going to see a similar phenomenon here,” Solomon said, drawing parallels to the internet frenzy of the late 1990s and early 2000s. The dot-com bubble, he recalled, saw sky-high valuations collapse when not all investments delivered expected returns. “I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets.”

Solomon emphasized that many investors are currently riding the “risk curve” driven by excitement, often underestimating potential pitfalls. “When people are excited, they tend to think about the good things that can go right, and they diminish the things you should be skeptical about that can go wrong,” he explained.

The AI boom has also prompted substantial spending on infrastructure, with pricey data center deals taking center stage as firms build the energy capacity to support new technologies. Solomon stressed that while the technology is promising, market cycles historically show that accelerated capital formation often leads to short-term overvaluation, followed by a correction.

“There will be a reset, there will be a check at some point, there will be a drawdown,” Solomon added. “The extent of that will depend on how long this bull run goes. Markets run in cycles, and whenever we’ve historically had a significant acceleration in a new technology that creates a lot of capital formation, you generally see the market run ahead of the potential.”

Despite his warnings, Solomon remains optimistic about AI’s long-term impact. He noted the technology’s potential to drive enterprise innovation and spawn new companies. “I sleep very well. I’m not going to bed every night worried about what will happen next,” he said. “Generally speaking, I think what’s super exciting is the technology is expanding, new companies are being formed, and the potential of this technology deployed into the enterprise can be very, very powerful. So, it’s an exciting time.”

At the same event, Amazon founder Jeff Bezos also described AI as currently being in an “industrial bubble,” echoing concerns over excessive hype. While both leaders acknowledge short-term risks, their comments highlight the dual nature of AI: a transformative force for innovation and a potential catalyst for market volatility.

As investors continue to pour capital into AI-driven ventures, Solomon’s advice underscores the importance of measured optimism, reminding the market that while there will be winners, there will inevitably be losers along the way.