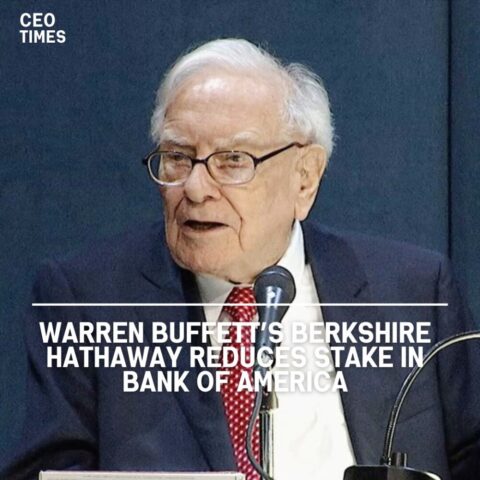

In a landmark portfolio move ahead of Buffett’s final months as CEO, Berkshire unveils a surprising Alphabet investment, trims major positions, and signals a strategic reset for the $1.1T conglomerate.

Berkshire Hathaway Reveals Major Portfolio Shift as Buffett Nears Leadership Transition

Warren Buffett’s Berkshire Hathaway has unveiled one of its most closely watched quarterly disclosures — and with it, a striking shift in the firm’s investment strategy. In a new filing with the U.S. Securities and Exchange Commission, the $1.1 trillion conglomerate revealed a $4.3 billion stake in Alphabet, marking its first significant move into Google’s parent company and signaling an unexpected pivot from Buffett’s long-standing reluctance toward big tech.

The filing shows that as of September 30, Berkshire held 17.85 million Alphabet shares, instantly making it the firm’s 10th-largest U.S. equity position. The investment stands out as a rare venture into a technology giant that Buffett once famously admitted he “blew it” by not buying early, despite recognizing similarities between Google’s advertising model and GEICO’s successful customer acquisition strategy.

Apple Stake Reduced Again — But Still Reigns Supreme

The revelation comes as Berkshire continues to scale back its long-held Apple position. During Q3, the firm reduced its holdings from 280 million to 238.2 million shares, continuing a multiyear trimming that has now seen Berkshire divest nearly three-quarters of the 905 million shares it once owned.

Even so, Apple remains Berkshire’s largest stock holding, valued at $60.7 billion, reinforcing Buffett’s view of Apple as a consumer brand rather than a pure tech company.

Active Buying and Selling in a High-Cash Era

The filing also highlighted Berkshire’s broader portfolio movements:

- $6.4 billion in stock purchases

- $12.5 billion in stock sales

- Record-high cash reserves of $381.7 billion, marking the 13th consecutive quarter as a net seller

Among the most notable changes, Berkshire:

- Sold 6% of its Bank of America shares, continuing reductions from last year

- Exited its position in homebuilder D.R. Horton

- Increased holdings in Chubb and Domino’s Pizza

Bank of America remains Berkshire’s third-largest stock holding, despite ongoing reductions.

A Strategic Reset as Buffett Prepares to Pass the Torch

This disclosure marks the final portfolio filing before Buffett ends his historic 60-year run as CEO on January 1, when Vice Chairman Greg Abel will assume leadership. Analysts view the growing cash pile and concentrated pruning as signs of caution amid high market valuations — and preparation for what may become a new chapter of disciplined deployment once Abel takes the helm.

With close to 200 businesses in its portfolio — spanning BNSF Railway, Berkshire Hathaway Energy, Fruit of the Loom, Dairy Queen, See’s Candies, and dozens more — the conglomerate’s next moves remain highly anticipated.

Berkshire’s unexpected step into Alphabet, paired with its methodical reshaping of long-term positions, suggests a blend of classic Buffett discipline and forward-looking adaptation — a defining moment as the legendary investor’s era comes to a close.