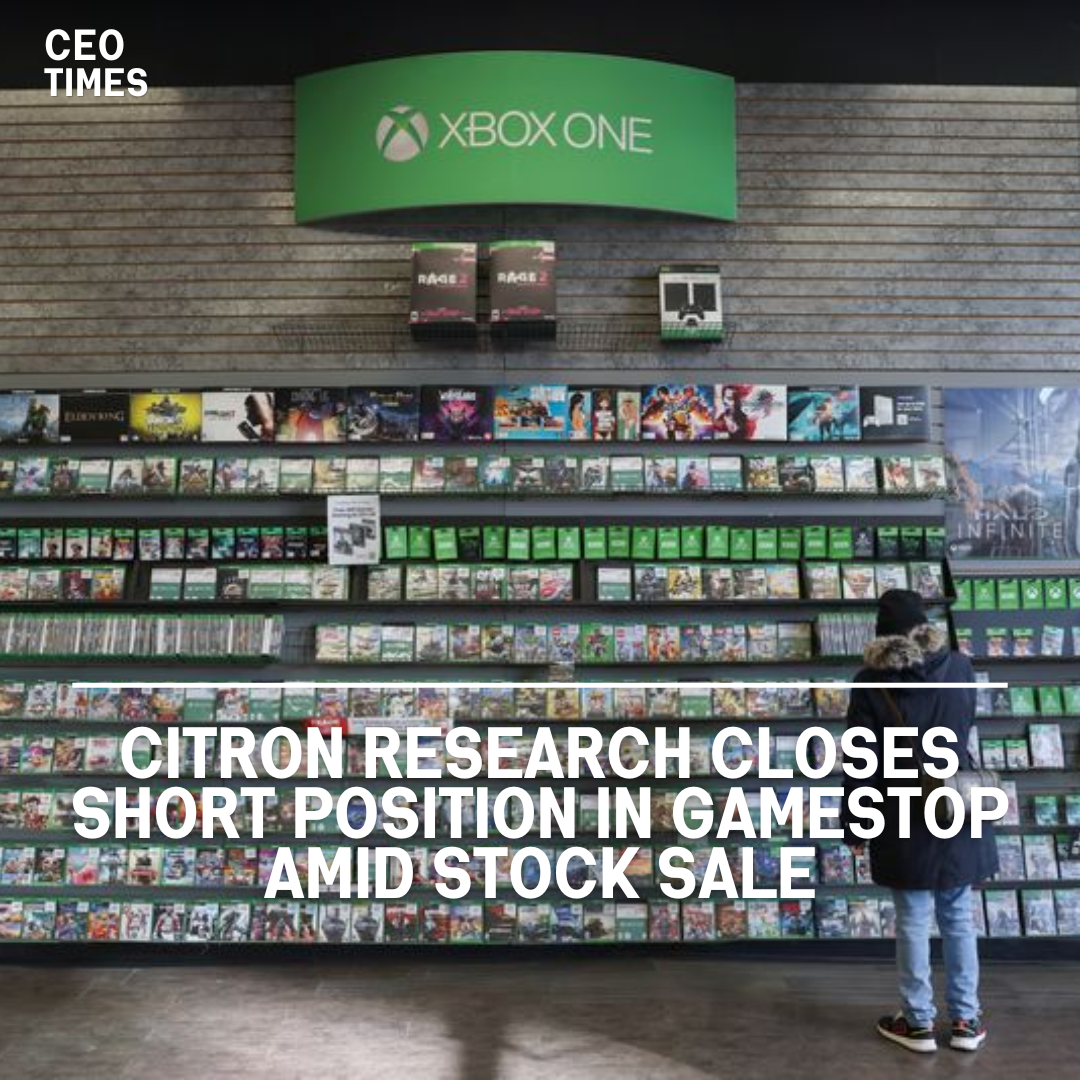

On Wednesday, Citron Research announced on X.com that it no longer holds a short position in GameStop, a popular stock among retail traders. This announcement comes just days after the firm had taken a bearish stance on the company.

Citron clarified their decision: “It’s not because we believe in a turnaround for the company fundamentals will ever happen, but with $4 billion in the bank, they have enough runway to appease their cult-like shareholders.”

Andrew Left, the founder of Citron Research, had previously indicated a renewed short position in GameStop, although significantly smaller than his 2021 position. During that period, retail traders had coordinated online to drive a massive rally in GameStop’s stock, forcing many hedge funds to close their short positions.

GameStop’s Recent Financial Moves:

GameStop recently raised $2.14 billion in gross proceeds from a stock sale announced last week, following a previous raise of $933.4 million in May.

This move capitalizes on the meme stock rally reignited by “Roaring Kitty” Keith Gill’s return to social media after a three-year hiatus.

The company intends to use the raised capital for general corporate purposes to stabilize and possibly expand its operations.

Market Reaction and Stock Performance:

The news of Citron closing its short position and GameStop’s stock sale immediately affected the market. GameStop’s stock saw a 4% increase in premarket trading on Wednesday.

Despite a 34% decline in value since Gill’s livestream on Friday, the stock has gained 70% since mid-May, reflecting the ongoing influence of retail traders and the renewed interest spurred by Gill’s return.

Looking Ahead:

Andrew Left mentioned that Citron Research would consider shorting GameStop again if the stock price reached the $45-$50 range. While the firm closed its recent short position at a profit, the exact size of the position was not disclosed.

This strategic exit and potential future actions highlight the continued volatility and unpredictability surrounding GameStop’s stock, influenced by both retail investor activity and institutional strategies.