Aviva Plc, a British insurer, has accused an Indian tax agency of violating local regulations that cap commissions paid to sales agents. The Directorate General of GST Intelligence (DGGI), responsible for overseeing indirect tax compliance, has alleged that Aviva’s India operations used fake invoices and clandestine cash payments to circumvent these regulations, according to a notice seen by Reuters.

Allegations and Findings:

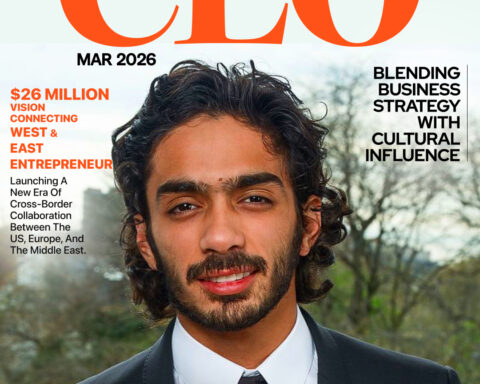

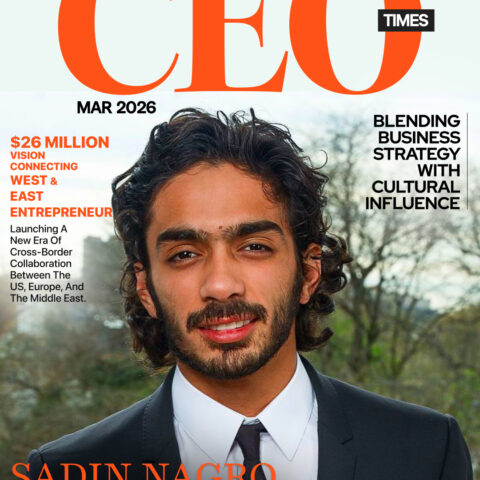

The tax notice, dated August 3, 2023, claims that between 2017 and 2023, Aviva’s India business funneled approximately $26 million to entities supposedly providing marketing and training services.

However, these vendors allegedly did not perform real work and were merely fronts used to channel funds to Aviva’s insurance agents. The DGGI alleges that Aviva’s actions were part of a “deep-rooted conspiracy” involving fake invoices, which allowed the company to improperly claim tax credits and evade $5.2 million in taxes.

Details from the Investigation:

The 205-page report from the DGGI includes extensive evidence, such as screenshots of emails and WhatsApp messages between Aviva executives and insurance distributors. These communications reportedly discuss strategies to bypass the regulatory limits on agent compensation.

Notably, the report mentions that Trevor Bull, the then-CEO of Aviva India, was copied on a 2019 email that discussed payments exceeding regulatory limits, suggesting that senior management was aware of these activities.

The report also mentioned Sonali Athalye, Aviva India’s Chief Financial Officer. According to the tax officials, Athalye described how the illicit payments were made during interviews conducted as part of the investigation.

Potential Consequences:

The notice is not publicly available and is part of a broader investigation into over a dozen Indian insurers accused of evading a combined $610 million in taxes, interest, and penalties. Aviva itself faces potential penalties amounting to $11 million, roughly equivalent to its 2023 profit from life insurance sales in India.

Aviva Response:

In response to inquiries, an Aviva spokesperson based in the UK stated, “We do not comment on speculation or ongoing legal matters.” Aviva’s Indian operations did not respond to requests for comment. However, a source familiar with the matter indicated that the company plans to challenge the allegations but has not yet formally responded to the notice.

This case underscores the growing scrutiny of financial practices in India’s insurance sector. Regulators are clamping down on activities that violate the country’s stringent commission regulations.