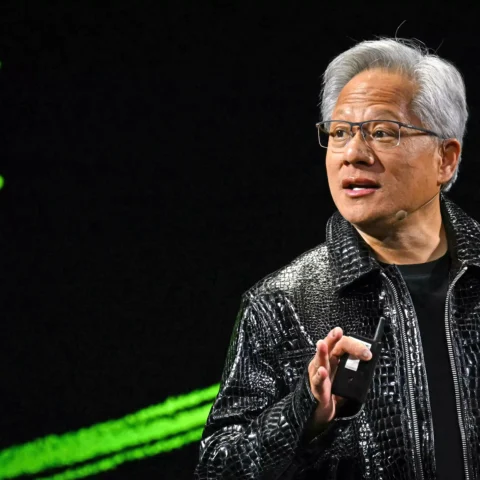

Nvidia, the Silicon Valley chip designer, reached a historic milestone on Friday as its market value briefly soared past $2 trillion for the first time.

This achievement underscores the unprecedented demand for its chips, which have become integral to the generative artificial intelligence sector, propelling Nvidia to the forefront of technological innovation.

Unprecedented Growth and Market Value Surge:

A series of record-breaking achievements have characterized Nvidia’s remarkable growth trajectory.

Following a robust revenue forecast announcement, the company’s market value surged by an astounding $277 billion on Thursday, marking the largest one-day gain in Wall Street history.

In just eight months, Nvidia’s market capitalization doubled from $1 trillion to $2 trillion, outpacing the trajectory of tech giants like Apple and Microsoft.

Charting the Ascension to $2 Trillion:

A line chart from LSEG Datastream illustrates Nvidia’s market capitalization journey alongside Microsoft and Apple, from their respective $1 trillion milestones to reaching $2 trillion.

This visual representation highlights Nvidia’s rapid ascent and unparalleled growth within the tech industry.

Nvidia’s chips have become indispensable components for nearly all major players in the generative artificial intelligence domain, including industry leaders like OpenAI and Google.

This dominance positions Nvidia as a key enabler of AI innovation, solidifying its status as a critical infrastructure provider in the burgeoning AI landscape.

Also Read: Meta Platforms Asserts Exemption from Indonesian Law

Stratospheric Share Price Surge:

Despite its already formidable position, Nvidia’s share price continues to soar, closing 0.4% higher on Friday and reaching a record high of $823.94 earlier in the session.

The company’s shares have surged nearly 60% this year, significantly contributing to the S&P 500’s overall gains.

Global Impact and Investor Interest:

Nvidia’s meteoric rise has captured the attention of investors worldwide, attracting significant interest and scrutiny.

The company’s market-beating forecasts and unparalleled growth prospects have drawn widespread admiration and attention from analysts and investors alike.

Future Growth Prospects:

Looking ahead, Nvidia’s future revenue growth is expected to remain robust, driven by increased capital expenditure from leading cloud computing companies to satisfy the growing demand for AI training and inference.

Analysts anticipate sustained revenue growth for Nvidia throughout fiscal 2025, positioning the company for continued success and market dominance in the years to come.