The world’s most valuable company concedes billions in revenue to secure export licenses — a first-of-its-kind agreement in the crossfire of U.S.-China tensions.

Nvidia, the world’s most valuable company, has landed in the heart of President Donald Trump’s escalating trade battle with China — and emerged with a groundbreaking, if costly, concession.

The $4.5 trillion tech giant, alongside rival AMD, has agreed to hand over 15% of all revenues from high-end AI chip sales to China directly to the U.S. government. In exchange, both companies will regain the ability to export restricted chips, including Nvidia’s H20 and AMD’s MI308 models, to the Chinese market.

The arrangement, which analysts estimate could generate $5 billion annually for the White House, represents an unprecedented fusion of trade policy, national security, and corporate strategy.

The Deal and the Stakes

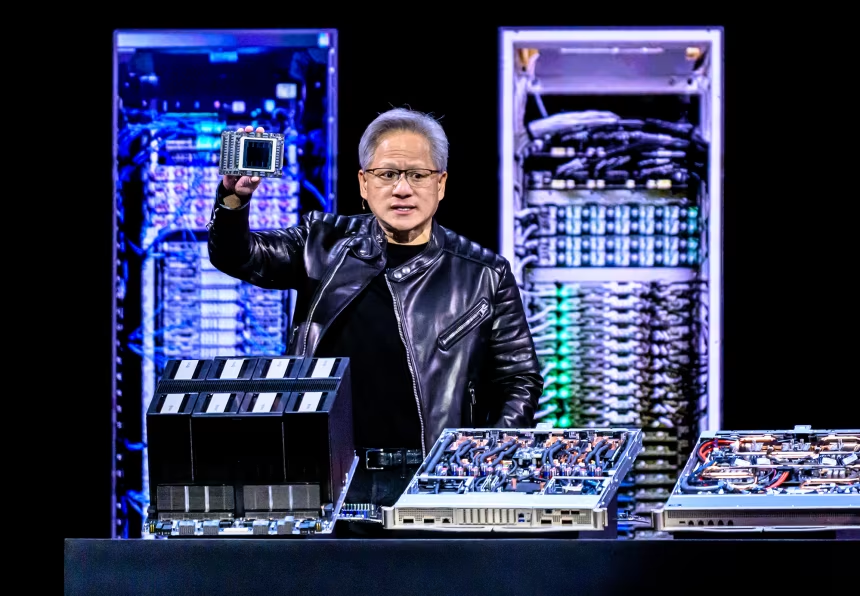

The agreement emerged after Nvidia CEO Jensen Huang met with President Trump last week, according to a U.S. official. Originally facing a 20% levy, Nvidia negotiated the rate down to 15%. Export licenses were granted Friday, though no shipments have yet been made.

Trump’s administration had blocked these chip exports in April over national security concerns. But the reversal, structured as a “voluntary payment” to sidestep constitutional bans on export taxes, opens the door for Nvidia and AMD to reenter China — a market that accounted for 13% of Nvidia’s sales in 2024.

“We follow rules the U.S. government sets for our participation in worldwide markets,” a Nvidia spokesperson said, expressing hope that export controls will allow America to “compete in China and worldwide.”

A First-of-Its-Kind Arrangement

Experts say the deal is without precedent.

“It’s hard to identify any historical precedent for this sort of arrangement,” said Sarah Kreps, a law professor at Cornell University. While the U.S. has seized stakes in strategically vital companies before — as in the 2009 bailout of General Motors and Chrysler — it has never taken a direct cut of foreign sales without an ownership stake.

Structured as a voluntary agreement, the payment avoids legal classification as a tax or tariff. Nvidia and AMD will have no control over how the U.S. spends the funds.

National Security vs. Economic Reality

For years, Washington has aimed to slow China’s AI progress by restricting access to advanced U.S. technology. But some officials now acknowledge that China is advancing regardless. Allowing sales through licensed channels, they argue, is preferable to driving purchases to the black market.

That view aligns with Huang’s position: restricting American chip sales, he says, encourages China to accelerate homegrown alternatives — eroding U.S. leadership in AI.

Billions at Stake

Despite the 15% cut, the Chinese market remains too lucrative to abandon. CFRA Research estimates Nvidia and AMD could generate $35 billion annually from these chip exports, even after the levy.

For Nvidia, whose H20 chips have been linked to advanced Chinese AI models like DeepSeek, regaining access could offset billions in losses suffered after April’s ban. Shares rose 0.5% Monday on news of the deal.

The Technology in Question

Trump has downplayed the H20’s capabilities, calling it “obsolete,” but industry experts disagree. While less powerful than Nvidia’s H100 or H200 series, the H20 remains highly sophisticated, especially in AI inference tasks.

Param Singh of Carnegie Mellon University notes that using H20 chips could slow the training of cutting-edge models — but not render them ineffective.

Blackwell on the Horizon?

Trump hinted at a possible future deal allowing exports of Nvidia’s ultra-advanced Blackwell chips — in a downgraded form. “The Blackwell is superduper advanced… nobody has it,” Trump said, suggesting any export would be “20% less” capable, similar to how the U.S. sells modified fighter jets to allies.

China’s Position

Chinese state media has questioned the security of American chips, raising the possibility of “backdoors” — a claim Nvidia denies. Analysts see this as posturing, intended to spur domestic innovation while leaving the door open for imports.

The Bigger Trade Picture

Treasury Secretary Scott Bessent has labeled Nvidia’s export controls a “negotiating chip” in wider U.S.-China trade talks. The 15% deal could be both a tactical concession and a bargaining tool — but Beijing’s skepticism suggests the game is far from over.

In the meantime, Nvidia and AMD have secured a path back into the world’s second-largest GPU market — albeit at a price. For the Trump administration, the deal offers billions in revenue and a symbolic win in its high-stakes balancing act between economic pragmatism and national security.