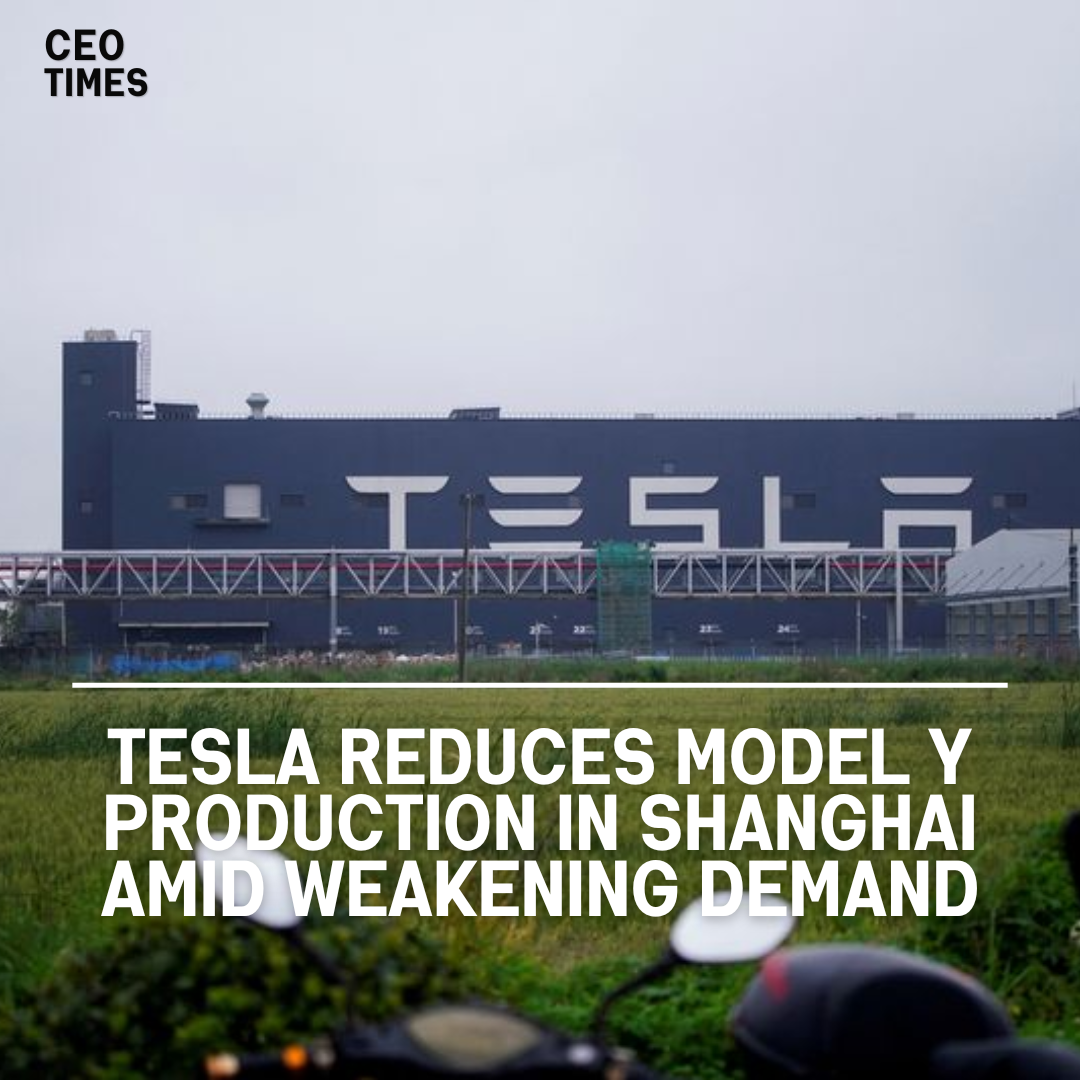

According to industry data and a source familiar with the matter, Tesla has reduced the output of its best-selling Model Y electric car by a double-digit percentage at its Shanghai plant since March.

This move is aimed at addressing the weakening demand for the U.S. automaker’s older model in China, its second-largest market.

The majority of the cars produced at the Shanghai plant are sold in China, where a fierce price war among electric vehicle (EV) makers has erupted amid an economic slowdown.

Production Cuts:

The Shanghai plant, Tesla’s biggest manufacturing hub globally, planned to cut Model Y output by at least 20% from March to June, according to the source who refused to be called due to the private nature of the information.

Data from the China Association of Automobile Manufacturers (CAAM) showed that Model Y’s output in China was 49,498 units in March and 36,610 in April, representing decreases of 17.7% and 33%, respectively, compared to the same period last year.

In total, Tesla produced 287,359 units of Model Y and Model 3 cars in China in the first four months of the year, a 5% decrease from the same period in 2023. However, Model 3 output was up 10% year-on-year, according to CAAM data.

Future Production Plans:

It is not immediately clear if the output cut will be extended into the year’s second half or if it will affect Model 3 production. Additionally, it remains uncertain whether Tesla’s plants in the United States and Germany will adopt similar output reductions. Tesla has not replied to requests for comment.

Sales Goals and Market Position:

Despite the output cuts and recent layoffs at Tesla’s China sales and charging service teams, the company still aims to sell between 600,000 to 700,000 cars in China in 2024 out of a global target of 2 million EVs, unchanged from the initial targets set at the beginning of the year.

This information was provided by a separate source who wished to remain unknown due to the lack of consent to speak to the media.

In April, Tesla cut Model Y prices in China to their lowest levels since the model was first launched in the country in 2021. To boost sales, Tesla also offered a zero-interest financing scheme for Model 3 buyers.

Market Share and Competition:

According to the China Passenger Car Association, Tesla’s share in China’s overall pure electric and plug-in hybrid market decreased to 6.8% in the first four months of this year from 7.8% in 2023, when it sold 603,664 cars in the country.

Homegrown competitor BYD led the segment with a 34.3% share for the first four months, down slightly from 35% for 2023.

Strategic Shifts:

Tesla’s latest impact report omitted its previous goal of delivering 20 million vehicles annually by 2030, indicating a potential strategic shift as the company focuses on robotaxis and breakthroughs in artificial intelligence to drive new revenue growth.