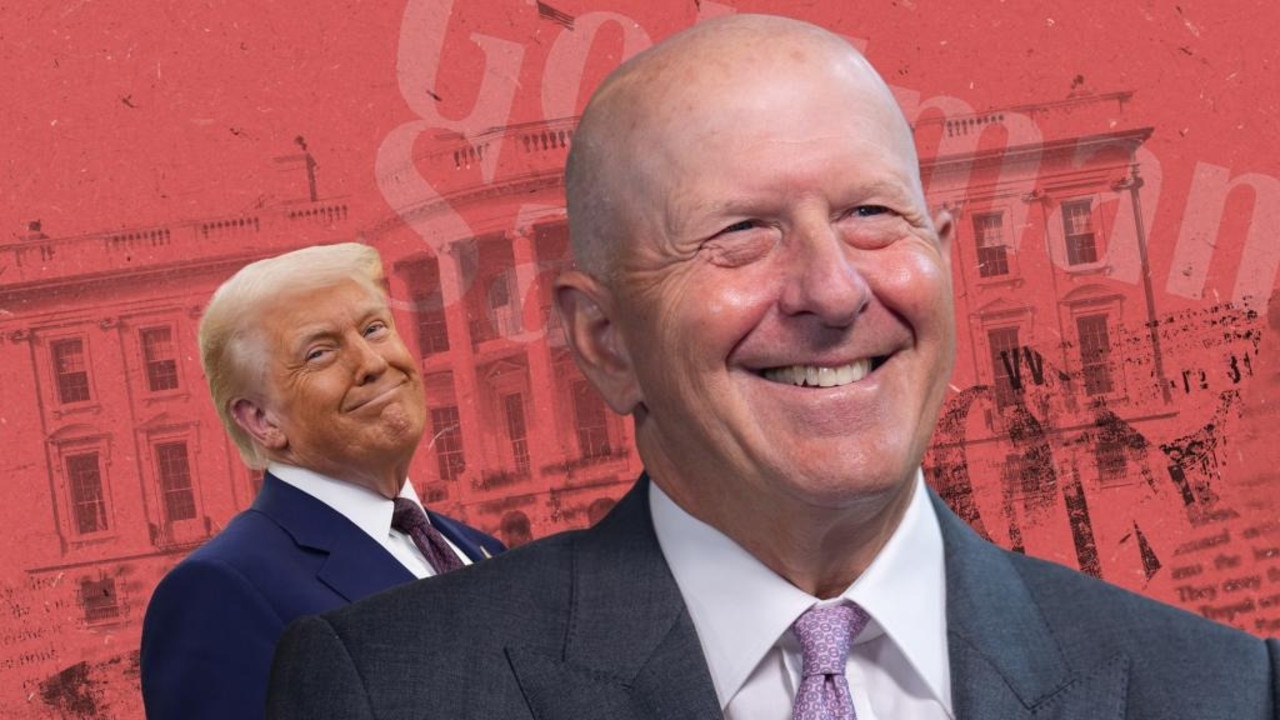

Former President pushes back on bank’s projection that U.S. consumers will bear most tariff costs, sparking fresh tension between Wall Street and politics.

Former U.S. President Donald Trump has publicly urged Goldman Sachs CEO David Solomon to replace the bank’s chief economist after research from the Wall Street giant suggested that American consumers will shoulder most of the costs from newly imposed tariffs.

In a post on Truth Social on Tuesday, Trump dismissed Goldman Sachs’ findings, writing, “Tariffs have not caused inflation, or any other problems for America, other than massive amounts of CASH pouring into our Treasury’s coffers.” He criticized the firm for “refusing to give credit where credit is due” and went on to say, “David Solomon should go out and get himself a new Economist or, maybe, he ought to just focus on being a DJ, and not bother running a major Financial Institution.”

Solomon, who once regularly performed as a DJ at high-profile events, stepped away from his music career two years ago following pressure from Goldman’s board. The former president’s remarks follow a weekend report by Goldman Sachs economists, led by Jan Hatzius, estimating that Americans had absorbed 22% of tariff costs through June — a share projected to rise to 67% by October if current trends persist.

Goldman Sachs declined to comment on Trump’s criticism. Hatzius, one of the most respected economists in both Washington and Wall Street circles, was among the few who correctly predicted in 2023 that the U.S. would avoid a recession. His latest report aligns with other major financial institutions warning of potential “tariff-related sticker shock” for consumers.

While tariffs have yet to significantly drive inflation, the latest Consumer Price Index shows prices rising 0.2% in July, keeping the annual inflation rate steady at 2.7%. Still, Trump remains firm in his stance that tariffs are a financial win for the U.S. Treasury — a position at odds with much of the economic analysis coming from Wall Street.