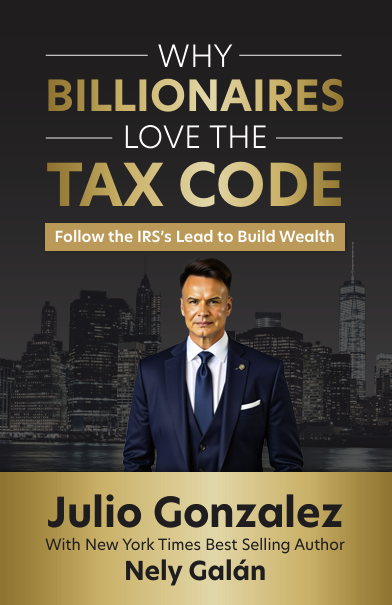

Julio Gonzalez has earned many titles in his remarkable career — national tax reform expert, industry pioneer, wealth strategist, and one of the most influential figures in modern accounting. But above every credential and accolade, he is a man driven by a single, transformative belief: the tax code should belong to everyone, not just the privileged few.

In a landscape where tax advantages have long been guarded by Fortune 500 companies and global institutions, Gonzalez became the rare visionary who chose a different path. Instead of preserving exclusivity, he built a bridge. Instead of limiting access, he opened the doors. And instead of keeping tax engineering an elite secret, he turned it into a tool that could empower families, entrepreneurs, and small businesses across the nation.

His journey began in 2001, when he founded Engineered Tax Services, now widely recognized as the largest specialty tax engineering firm in America. What started as a mission to support accounting firms has grown into a national movement toward fairness, innovation, and economic possibility. Gonzalez took services that once lived only inside the walls of multinational corporations and placed them into the hands of everyday business owners who needed them most.

Through ETS, he introduced a powerful idea to the marketplace — that engineering and tax strategy, when combined with intention, can strengthen companies, create jobs, preserve industries, and uplift entire communities. This philosophy reshaped how America thinks about tax incentives, turning cost segregation, R&D credits, energy incentives, and tax-focused engineering into pathways for growth rather than tools reserved for the privileged.

But Gonzalez’s impact reaches far beyond boardrooms and balance sheets. He is one of the rare experts trusted inside the halls of policy-making, advising Congress, the Senate, and federal agencies on how to modernize the tax system for a new era of innovation. His voice has influenced national reform, shaped economic discussions at the highest level, and guided the country toward policies that support business owners, working families, and the long-term strength of the U.S. economy.

As his influence expanded, so did his vision. Gonzalez began acquiring organizations that would strengthen the accounting industry from the inside out, transforming ETS into a full ecosystem that supports CPA firms, entrepreneurs, and wealth builders nationwide. His leadership is marked not by scale alone, but by intention — every acquisition, every partnership, and every new venture serves his core belief that financial tools should create equality, not division.

Beyond his corporate achievements, Gonzalez formed the Gonzalez Family Office, a platform dedicated to investing in American industries, infrastructure projects, and philanthropic endeavors. His approach to wealth is not about accumulation — it is about responsibility. It is about ensuring that economic prosperity is shared, sustainable, and deeply rooted in communities.

Today, Julio Gonzalez stands as a symbol of what modern leadership should look like. Bold enough to challenge a system, skilled enough to rebuild it, and compassionate enough to ensure everyone rises with it. His story resonates across continents — including Dubai, where innovation and ambition form the heartbeat of the region — because his message is universal: opportunity should never be exclusive.

In the world of taxes and wealth, he has become a storyteller, a builder, a reformer, and a champion of fairness. And in the pages of Dubai Business Magazine, he represents something even greater — a blueprint for what one individual can achieve when purpose becomes more important than power.

Julio Gonzalez did not just change a tax code.

He changed the way a nation thinks about possibility.

Instagram: @taxreformexpert_