Bitcoin is poised to achieve its most significant monthly gain in over three years, propelled by a surge in cash inflows into listed funds.

With its market capitalization dominance, Cryptocurrency is on track for a remarkable 44% increase in February, marking its most substantial monthly surge since December 2020.

Broad Market Momentum:

The enthusiasm surrounding Bitcoin’s rally is also raising the value of other cryptocurrencies, notably Ether, which has surged by 50% during February, demonstrating the broader momentum within the digital asset market.

Anticipated Record-Breaking Rally of Bitcoin:

Analysts predict that Bitcoin’s upward trajectory may lead to a test and potential breakthrough of the $69,000 mark, surpassing its previous record high during the cryptocurrency peaks in November 2021.

Coinbase Global’s CEO acknowledged the exchange’s struggle to manage an overwhelming surge in user traffic amidst the current bitcoin rally, highlighting the strain on exchange infrastructure caused by heightened market activity.

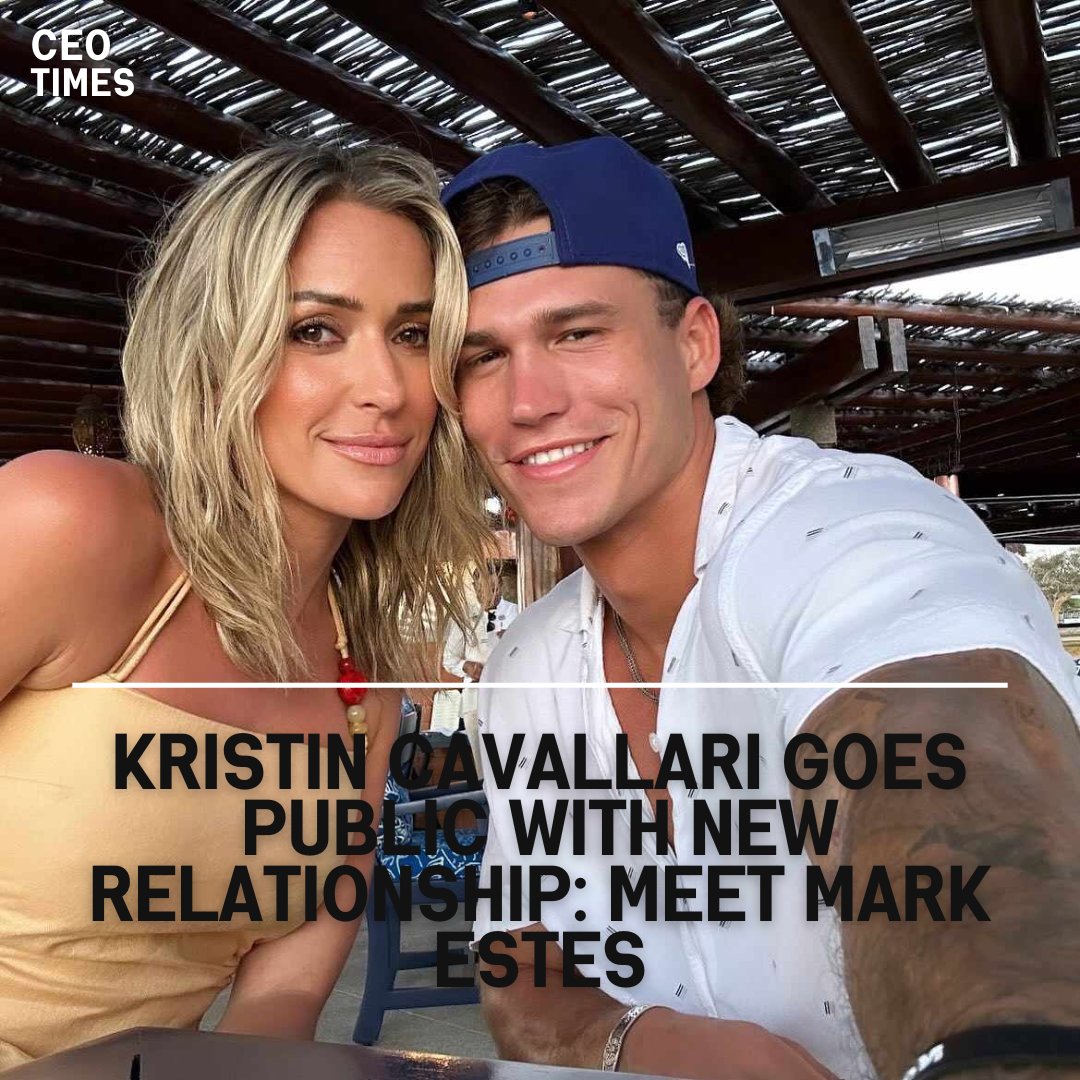

Also Read: Kristin Cavallari Goes Public with New Relationship: Meet Mark Estes

Unconventional Market Dynamics:

While some analysts caution against potential market overheating and bubble-like conditions, others perceive Bitcoin’s resurgence as indicative of its return to a parabolic rally phase without immediate signs of reaching a peak.

The recent approval and launch of spot bitcoin exchange-traded funds (ETFs) in the United States have attracted new investors and revitalized interest in the cryptocurrency market. This development follows a period of subdued enthusiasm during the “crypto winter” of 2022.

Investor Optimism and Market Dynamics:

In anticipation of April’s halving event, during which the rate of new bitcoin issuance is halved, traders have intensified their positions in bitcoin.

Furthermore, investor appetite for higher-yielding and more volatile assets has been fueled by the Federal Reserve’s expectations of multiple rate cuts amidst a backdrop of low foreign exchange and equity market volatility.