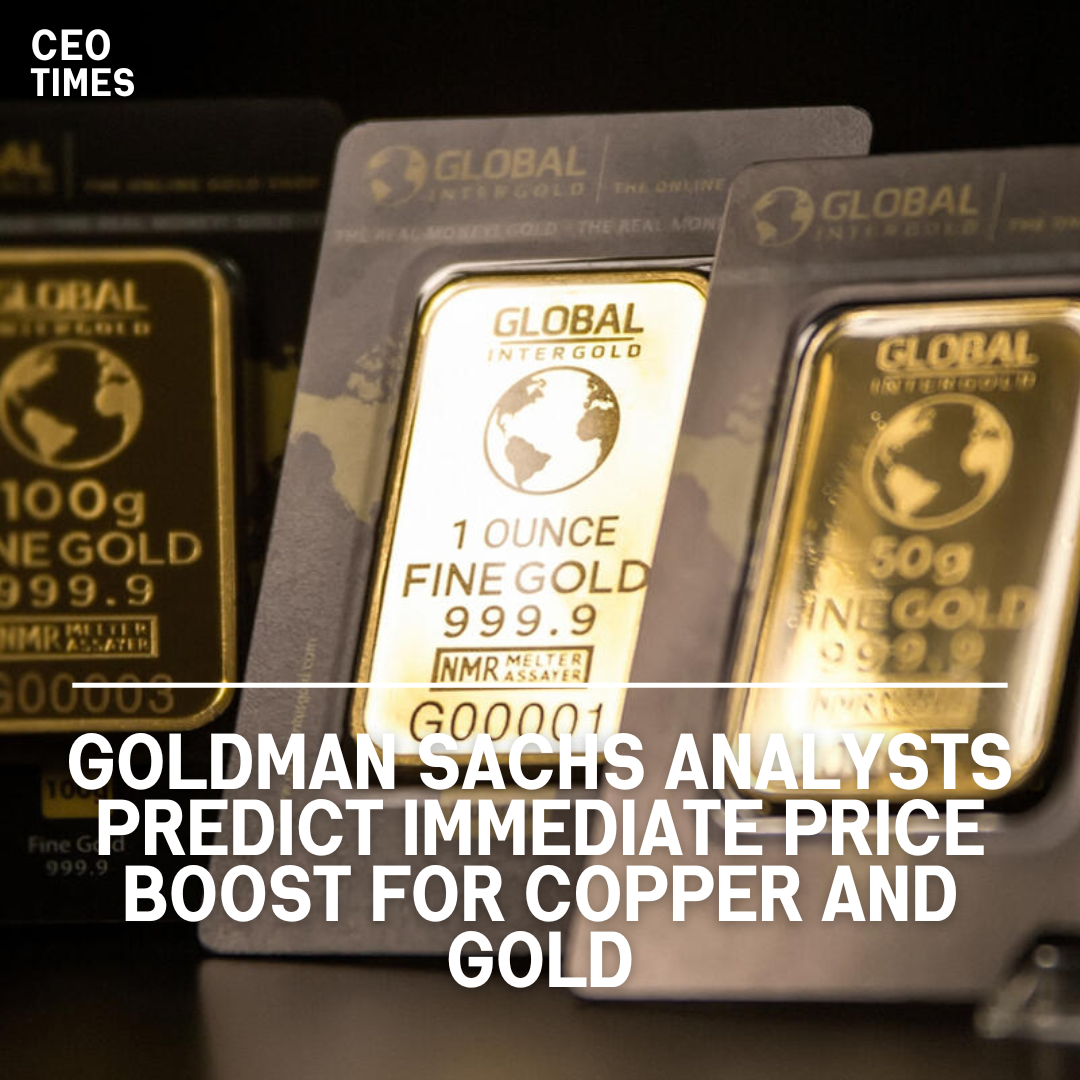

Analysts at Goldman Sachs anticipate that copper and gold will experience the most significant immediate price surge in the commodities sector in response to potential interest rate cuts by the U.S. Federal Reserve.

Copper and Gold Lead the Way, Says Goldman Sachs:

According to Goldman Sachs, a 100 basis point decline in U.S. 2-year rates could lead to a 6% increase in copper prices and a 3% rise in gold prices.

This projection suggests that metals will be the primary beneficiaries of rate cuts, followed by oil with a 3% boost.

As of 0542 GMT on Wednesday, three-month copper on the London Metal Exchange was trading close to a three-week high of $8,548 per metric ton, while spot gold was at a near two-week high at $2,030.30 per ounce.

Also Read: Bitcoin Surges Past $1 Trillion Mark, Drives Crypto Market to $2 Trillion

Limited Impact on Natural Gas and Agricultural Commodities:

Goldman Sachs indicates that natural gas and agricultural commodities are unlikely to experience significant price effects from rate cuts.

Micro factors such as seasonal inventory cycles and weather patterns are expected to outweigh any impact from interest rate adjustments.

Ambiguous Impact of Rate Cuts:

While lower interest rates can potentially stimulate both commodity demand and supply, Goldman Sachs notes that the overall impact on commodity prices remains ambiguous in theory.

However, in practice, the positive effects of lower rates on inventory costs and GDP growth through improved financial conditions are expected to dominate.

Federal Reserve Expectations:

Economists polled by Reuters suggest that the U.S. Federal Reserve may cut the federal funds rate in June, although there is a greater risk that the first-rate cut could be delayed beyond initial forecasts.

This potential monetary policy shift could further influence commodity markets in the coming months.