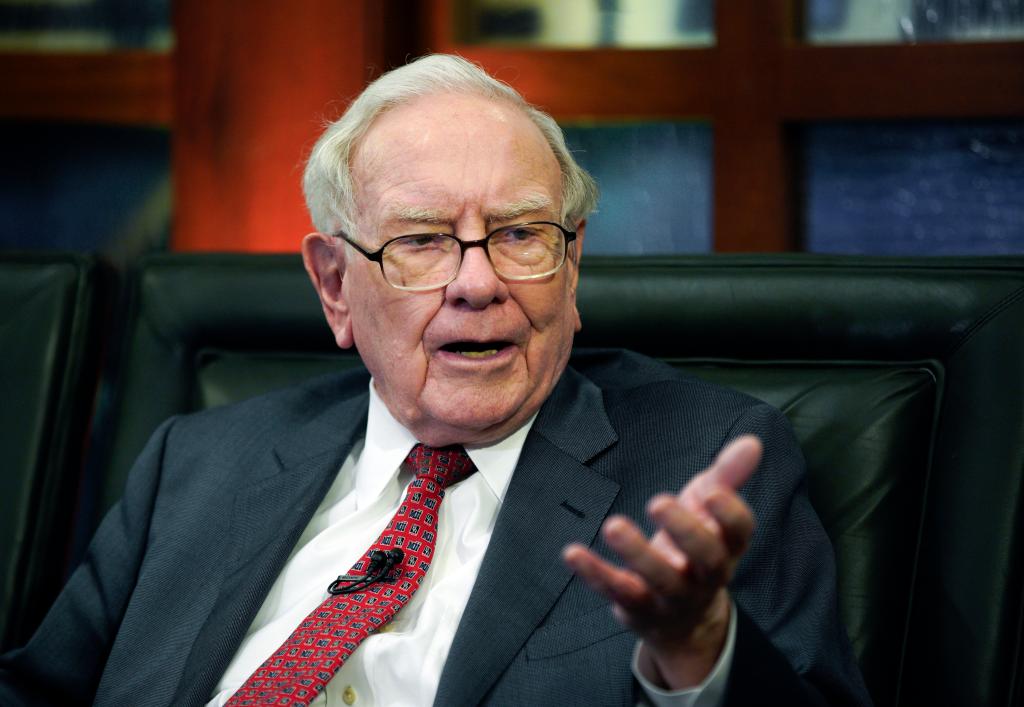

Warren Buffett’s Potential Last Big Deal Signals a Passing of the Torch

Berkshire Hathaway has announced the $9.7 billion purchase of Occidental Petroleum’s chemical division, OxyChem, in a move that may mark the final major acquisition of Warren Buffett’s legendary career. The deal, revealed on Thursday, reflects both Buffett’s enduring dealmaking influence and the gradual transition of leadership to Vice Chair Greg Abel, who is set to become Berkshire’s CEO in January 2026.

Notably, Buffett’s name was absent from Berkshire’s official communications on the deal, underscoring Abel’s growing prominence. While Buffett will remain chairman and retain a role in capital allocation decisions, the omission suggests the company is preparing for a future beyond its iconic leader.

A Rare Mega-Deal in an Expensive Market

For years, Buffett has struggled to find large acquisitions at attractive prices, with Berkshire’s cash reserves swelling to more than $344 billion. The last major deal was the $11.6 billion acquisition of Alleghany Insurance in 2022. Rising competition from hedge funds and private equity has pushed valuations higher, making such deals increasingly scarce.

The purchase of OxyChem marks a return to form. The division produces a wide range of industrial chemicals, including chlorine for water treatment, vinyl chloride for plastics, and calcium chloride for road safety. These operations complement Berkshire’s 2011 acquisition of Lubrizol, another chemical giant bought for $9 billion.

“OxyChem brings a robust portfolio of operating assets, supported by an accomplished team,” Abel said in a statement. “We look forward to welcoming OxyChem as an operating subsidiary within Berkshire.”

Occidental’s Debt Strategy

For Occidental, the sale is a critical step in managing debt. The company expects to use $6.5 billion of the proceeds to reduce its borrowings, targeting principal debt below $15 billion. This comes on the heels of its $12 billion CrownRock acquisition in December 2023, which left the oil major with $7.5 billion in new debt. Since then, Occidental has sold off roughly $4 billion in assets, and the OxyChem sale accelerates that deleveraging effort.

In the second quarter of 2024, OxyChem generated $213 million in pretax earnings for Occidental, down from nearly $300 million a year earlier. Still, the business remains a profitable, diversified operation well-suited to Berkshire’s model of holding strong, cash-generating subsidiaries.

Buffett’s Complicated Ties to Occidental

The deal also adds another layer to Berkshire’s already deep relationship with Occidental. Berkshire owns over 28% of Occidental’s stock and holds warrants to purchase nearly 84 million additional shares at $59.59 each. In addition, it owns $8.5 billion in preferred shares acquired in 2019, which pay a generous 8% annual dividend.

Buffett has repeatedly told shareholders he had no plans to buy all of Occidental, even as Berkshire continued to accumulate shares. The OxyChem purchase cements the connection while allowing Occidental to refocus on its core oil and gas business.

A Legacy of Landmark Deals

Over six decades, Buffett has transformed Berkshire Hathaway into one of the most influential conglomerates in the world. Its portfolio spans iconic companies like Geico, Dairy Queen, See’s Candies, and BNSF Railway, alongside vast utility holdings and a stock portfolio worth over $250 billion. Berkshire’s equity stakes in Apple, Coca-Cola, Bank of America, and American Express alone form a cornerstone of its value.

With this latest deal, Buffett’s legacy as one of history’s greatest capital allocators remains secure. Yet the quiet handoff of the OxyChem transaction also signals the dawn of a new era at Berkshire—one in which Greg Abel will lead the conglomerate’s next chapter while Buffett, now 95, steps back from the spotlight.