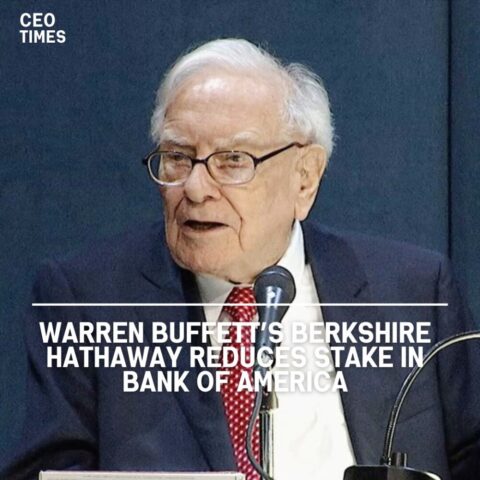

Berkshire Hathaway, the well-known investment firm led by Warren Buffett, recently divested 1.3 million Hong Kong-listed shares of electric vehicle manufacturer BYD.

The transaction, disclosed in a stock exchange filing on Monday, amounted to HK$310.5 million ($39.8 million).

Details of the Transaction:

- Date of Sale: The sale took place on June 11, 2024.

- Financial Impact: Berkshire Hathaway’s sale reduced its holdings in BYD’s issued H-shares from 7.02% to 6.90%.

- Value: The transaction was valued at approximately HK$310.5 million ($39.8 million).

Berkshire Hathaway Strategy:

Warren Buffett’s Berkshire Hathaway has been known for its strategic investments across various sectors globally.

The decision to sell a portion of its stake in BYD, a prominent player in the electric vehicle market, may reflect Berkshire’s portfolio adjustments or profit-taking amidst market conditions.

BYD’s Market Presence:

BYD, headquartered in China, has gained recognition for its advancements in electric vehicles and renewable energy solutions.

The company’s growth trajectory and technological innovations have garnered significant investor interest, including from Berkshire Hathaway in previous years.

Market Reaction:

The sale of Berkshire’s shares in BYD underscores ongoing developments in the electric vehicle sector and broader market trends influencing investment decisions by major institutional investors.