Intel CEO Pat Gelsingeralong and key executives are set to present a strategic plan to the company’s board of directors later this month. The proposal aims to reduce overall costs by divesting non-essential businesses and revising capital expenditures as Intel struggles to regain its position in the competitive semiconductor industry.

Focus on Cost Reduction and Asset Sales:

The plan includes selling several business units, including Intel’s programmable chip division, Altera, which the company reportedly can no longer support given its diminished profits. The goal is to streamline processes and focus on more profitable areas within Intel’s business portfolio.

Gelsinger and his team are expected to present this plan during a mid-September board meeting. The specifics of the proposal, particularly those concerning Intel’s manufacturing operations, are still being finalized and could change before the meeting.

No Immediate Plans for Foundry Business Sale:

Although the proposal is expected to outline significant cost-saving measures, it does not currently include plans to sell off Intel’s contract manufacturing (foundry) operations.

The foundry business has been separated from Intel’s design division, and financials have been reported independently since the first quarter of this year.

This separation was intended to ensure confidentiality and prevent conflicts of interest between Intel’s design and manufacturing clients.

Challenges Facing Intel:

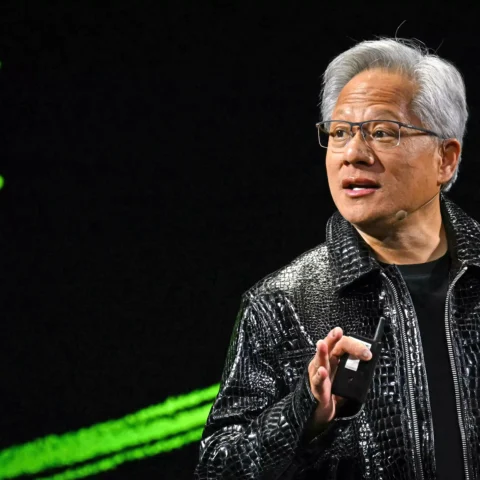

Intel has been navigating one of the most challenging periods in its history, trying to catch up with competitors like Nvidia, which has emerged as the dominant player in the AI chip market.

Following a disappointing second-quarter earnings report in August, Intel’s market capitalization has fallen below $100 billion, a stark contrast to Nvidia’s $3 trillion valuation.

Potential Impact on Capital Spending:

The proposal will likely include plans to further reduce Intel’s capital spending on factory expansion projects. This could involve pausing or halting the construction of its $32 billion factory in Germany, which has already faced delays. Intel has announced plans to cut its capital spending to $21.5 billion by 2025, a 17% reduction from this year.

Intel has engaged financial advisors from Morgan Stanley and Goldman Sachs to assist with evaluating and potentially selling various business units. The company has not yet solicited bids for the product units but is expected to do so following the board’s approval of the plan.