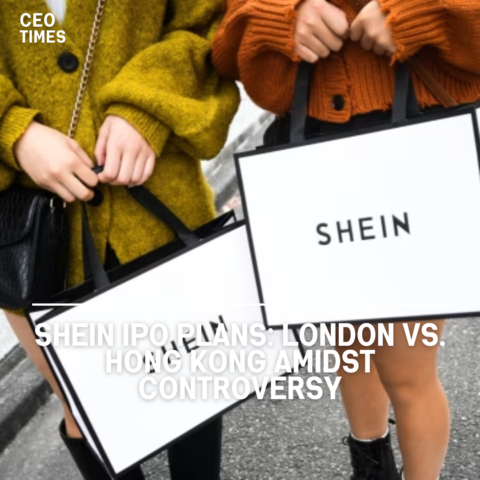

Shein, the Chinese-founded fast fashion retailer, has confidentially filed papers with Britain’s markets regulator, the Financial Conduct Authority (FCA), in early June for a potential listing on the London Stock Exchange (LSE).

Two sources familiar with the matter say this move could lead to one of the largest initial public offerings (IPOs) globally in 2024.

Valuation and Advisor Engagement:

Valued at $66 billion during a fundraising round last year, Shein has actively engaged with financial and legal advisors to explore the listing. Sources had indicated in May that the company began these preparations early in the year.

The exact timing for Shein’s IPO launch remains unclear. The sources, who asked for anonymity due to the sensitivity of the information, did not provide further details on the schedule.

Company and Regulatory Responses:

Shein’s spokesperson declined to comment on the matter, and the FCA did not immediately respond to Reuters’ request for comment.

If successful, Shein’s IPO could significantly impact the London financial market, substantially boosting the LSE. Known for its affordable fashion, Shein’s potential listing underscores the growing influence of fast fashion in global markets.