Masayoshi Son’s bold pivot marks a defining moment in SoftBank’s AI strategy — shifting focus from chip manufacturing to the intelligence powering the next technological revolution.

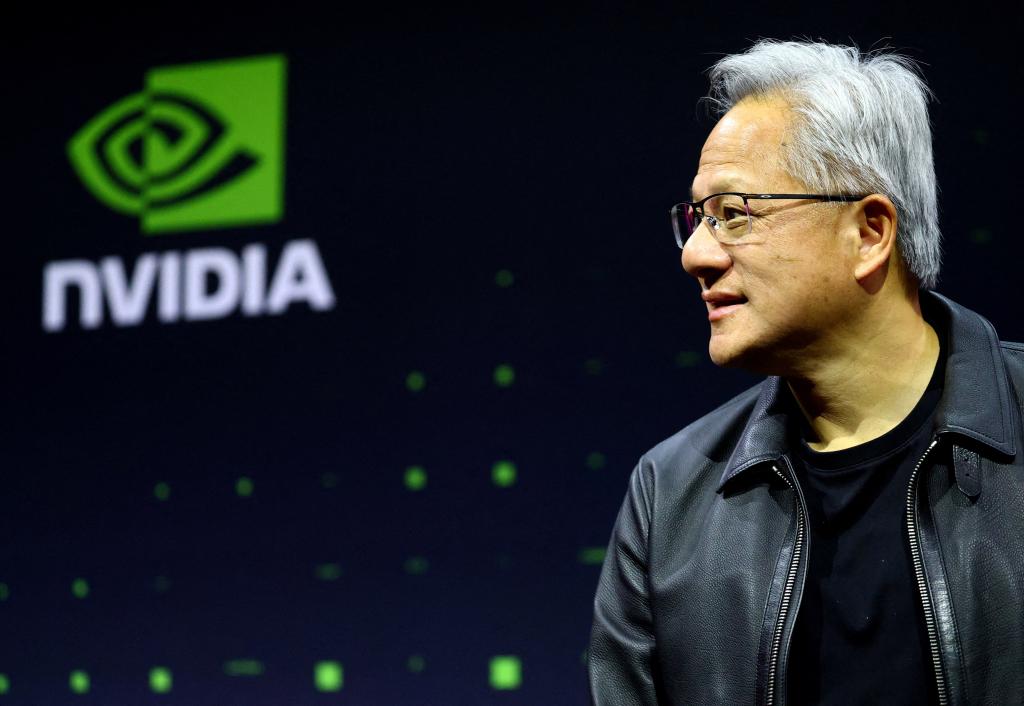

In a dramatic reshaping of its artificial intelligence portfolio, SoftBank Group Corp. has sold its entire $5.83 billion stake in Nvidia, signaling a decisive shift toward a deeper partnership with Sam Altman’s OpenAI. The move, confirmed in an earnings report released Tuesday, underscores CEO Masayoshi Son’s “all-in” commitment to artificial general intelligence (AGI) and his ambition to position SoftBank at the forefront of the AI-driven future.

According to the filing, SoftBank sold all 32.1 million Nvidia shares in October, alongside a partial divestment of its $9.17 billion stake in T-Mobile. The proceeds, insiders told CNBC, will serve as key funding sources for SoftBank’s $22.5 billion investment in OpenAI — as well as other next-generation tech ventures under Son’s Vision Fund.

“We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength,” said SoftBank CFO Yoshimitsu Goto during the investor presentation. “Through those options and tools, we make sure that we are ready for funding in a very safe manner.”

The strategic divestment comes amid mounting debate across Wall Street on whether AI chipmakers like Nvidia are overvalued, as staggering investments in AI infrastructure continue to outpace near-term returns. Despite Nvidia’s record-breaking performance in 2024, shares fell over 3% in early trading following the announcement.

Industry analysts see the sale as a calculated move. Wong Kok Hoi, CEO of APS Asset Management, noted, “Son is a savvy investor, so selling the entire stake must mean that he is no longer optimistic about the share price. Big tech companies may continue to invest heavily in GPU chips, but not at this year’s level for many years.”

SoftBank’s relationship with Nvidia has been cyclical. The Japanese conglomerate first invested $4 billion in Nvidia in 2017, before exiting in 2019 — only to return years later amid the AI boom. This latest exit suggests a long-term reorientation toward AI software and intelligence platforms, rather than hardware dependencies.

Son’s conviction in OpenAI’s future is well documented. In June, he declared he was “all in on OpenAI,” expressing a vision for SoftBank to “become the organizer of the industry in the artificial superintelligence era” — an era where AI could surpass human cognitive capabilities.

The strategy appears to be paying off in the near term. SoftBank’s second-quarter profit soared to 2.5 trillion yen ($16.6 billion), driven largely by the soaring valuation of OpenAI and its affiliated ecosystem.

Beyond OpenAI, SoftBank is also playing a pivotal role in President Trump’s $500 billion “Stargate” AI infrastructure project, which aims to expand AI data centers across the United States to support the next wave of machine learning and superintelligence initiatives.

From a hardware investor to a software visionary, Masayoshi Son’s latest move cements SoftBank’s transformation from a traditional tech investor to a catalyst in shaping the global AI future. His willingness to part with Nvidia — the undisputed leader in AI chips — underscores a belief that the real value of the next decade lies not just in the chips that power AI, but in the minds that design and direct it.