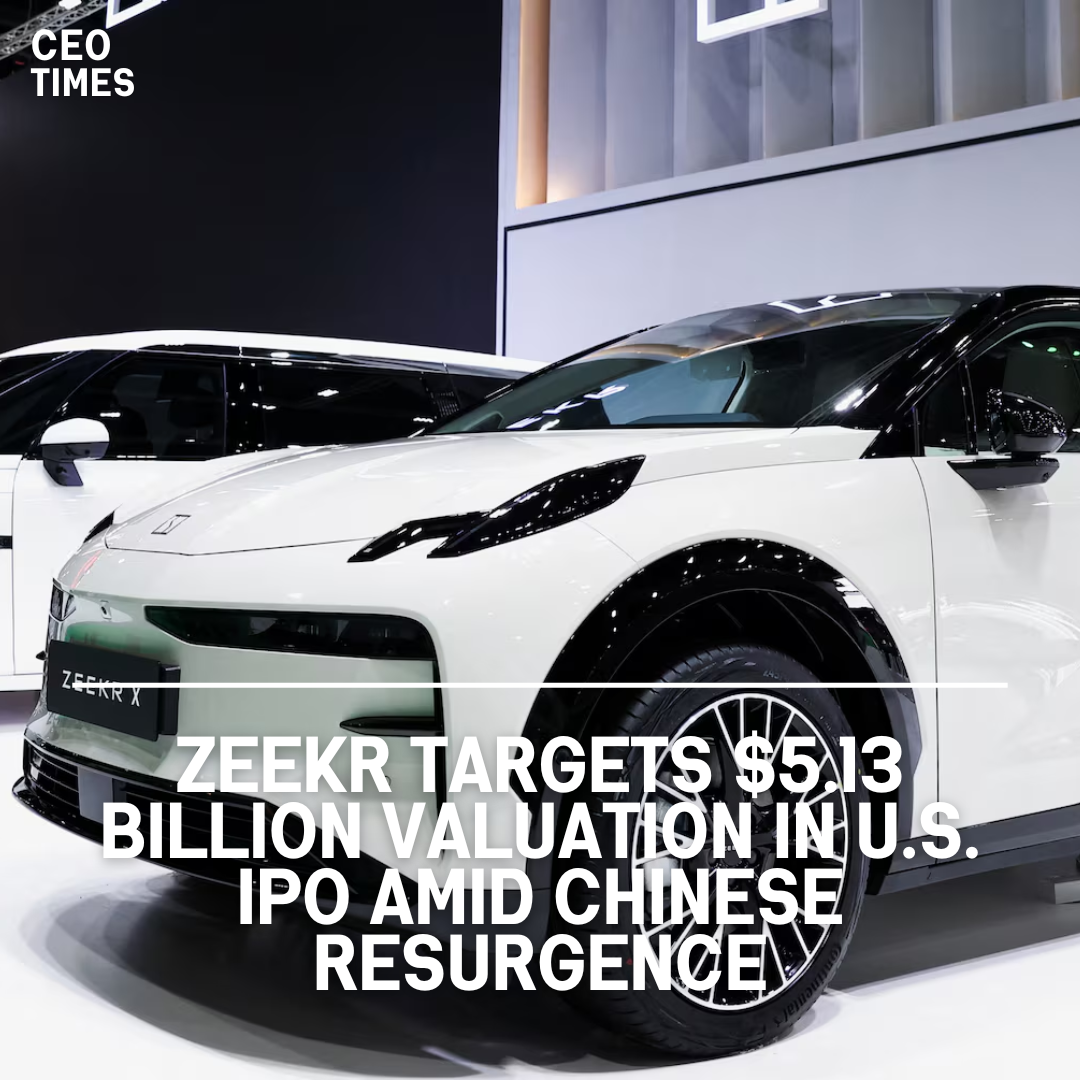

Electric vehicle manufacturer Zeekr Intelligent Technology Holding aims for a valuation of up to $5.13 billion in its upcoming U.S. initial public offering (IPO), marking a notable milestone as the first major floatation of a China-based company in over two years.

IPO Details:

Zeekr intends to raise $367.5 million by offering 17.5 million American depositary shares (ADSs) priced between $18 and $21 each. The IPO will gauge investor sentiment toward Chinese companies amidst ongoing geopolitical tensions and regulatory concerns.

Market Landscape:

Amid simmering tensions between the U.S. and China, the IPO represents a test of investors’ appetite for Chinese firms. The number of Chinese IPOs in the U.S. has declined, reflecting regulatory uncertainties and geopolitical challenges.

Recent regulatory developments, including resolving audit disputes between the U.S. and China, have paved the way for a revival in Chinese listings in the U.S. Zeekr’s IPO, which reflects improved regulatory clarity and market conditions.

Company Profile:

Zeekr, last valued at $13 billion after a funding round in February last year, highlights risks related to Chinese government influence and intense competition in the EV market. Notable shareholders, including Geely Auto, Mobileye, and CATL, express interest in subscribing to the IPO.

Underwriters and Investors:

Goldman Sachs and Morgan Stanley served as underwriters for the IPO, underscoring investor confidence. Zeekr’s successful listing would expand the portfolio of publicly listed auto companies owned by Geely Auto, reflecting its strategic diversification efforts.