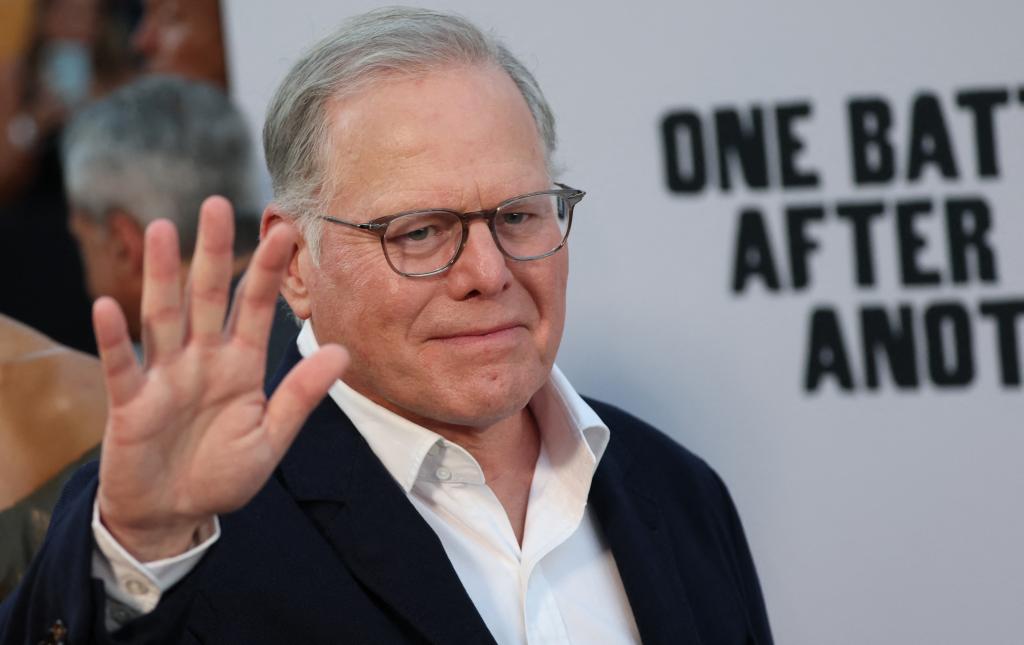

As competition intensifies and Trump-era resistance looms, Roberts considers a bold multibillion-dollar play to reshape Comcast’s future and challenge Hollywood’s evolving power structure.

In a high-stakes Hollywood showdown, Comcast CEO Brian Roberts is signaling that he’s ready to raise the stakes in the battle for Warner Bros. Discovery (WBD), even as political pushback and fierce industry competition mount. Sources with direct knowledge confirm that Roberts, determined to revive Comcast’s shrinking media empire, plans to enter a second round of bidding for WBD next week—potentially with an offer powerful enough to eclipse his rivals.

According to insiders, Roberts is weighing a bid that could value WBD’s studio and streaming businesses as high as $27 to $28 per share, surpassing Paramount Skydance’s roughly $60 billion offer for the entire company. It would also likely edge out Netflix’s first-round proposal, as the streaming giant vies to add WBD’s No. 1 Hollywood studio and No. 3 global streaming service, HBO Max, to its portfolio.

Yet the bold pursuit comes with significant political risk. The Trump administration has shown strong reluctance to approve any major deal involving Comcast, due in part to Roberts’ long oversight of the Trump-critical cable channel MS NOW. Despite this, Roberts is said to believe that securing WBD is essential to Comcast’s survival in a rapidly consolidating media landscape.

Media analysts echo that urgency. Rich Greenfield of LightShed Partners says that if Comcast loses the bid, it risks being left behind entirely. “Can you imagine what happens if Comcast loses, what happens to Peacock? They will be the only ones on the dance floor with no obvious partner,” Greenfield told On The Money.

Comcast faces persistent challenges, including a lagging streaming service in Peacock, a struggling NBC network, and mounting debt as it prepares to spin off legacy cable assets. A WBD acquisition could offer the scale, content library, and strategic leverage the company desperately needs.

Still, valuation complexities cloud the landscape. Comcast is only interested in WBD’s studio and streaming operations, not its cable networks, making it harder for the WBD board to directly compare offers. Roberts would also need to borrow substantially or secure equity partners given Comcast’s constrained balance sheet.

Meanwhile, Netflix has launched a charm offensive of its own. WBD board members are reportedly warming to Netflix’s arguments that an acquisition would avoid major antitrust concerns due to “category ambiguity”—a reference to the vast and unstructured nature of digital content distribution across Netflix, YouTube, and social media.

Political headwinds remain a major variable. Trump’s DOJ antitrust division, led by Gale Slater, would likely subject Comcast’s bid to a prolonged, two-year review process followed by a court battle with no guaranteed outcome. Netflix and Paramount Skydance, by contrast, may receive a smoother regulatory path, especially the latter: a company run by David Ellison and backed by his father, Larry Ellison—both favored by Trump.

With the second-round bidding deadline of December 1 approaching fast, Roberts faces a pivotal decision. Will he confront political obstacles head-on in pursuit of Hollywood dominance, or step back to avoid a potentially costly and uncertain regulatory war?

As the competition tightens and Hollywood’s future hangs in the balance, one thing is clear: the WBD board, along with CEO David Zaslav, holds the power to reshape the entertainment industry for years to come—either through a split sale or a massive full-company acquisition.