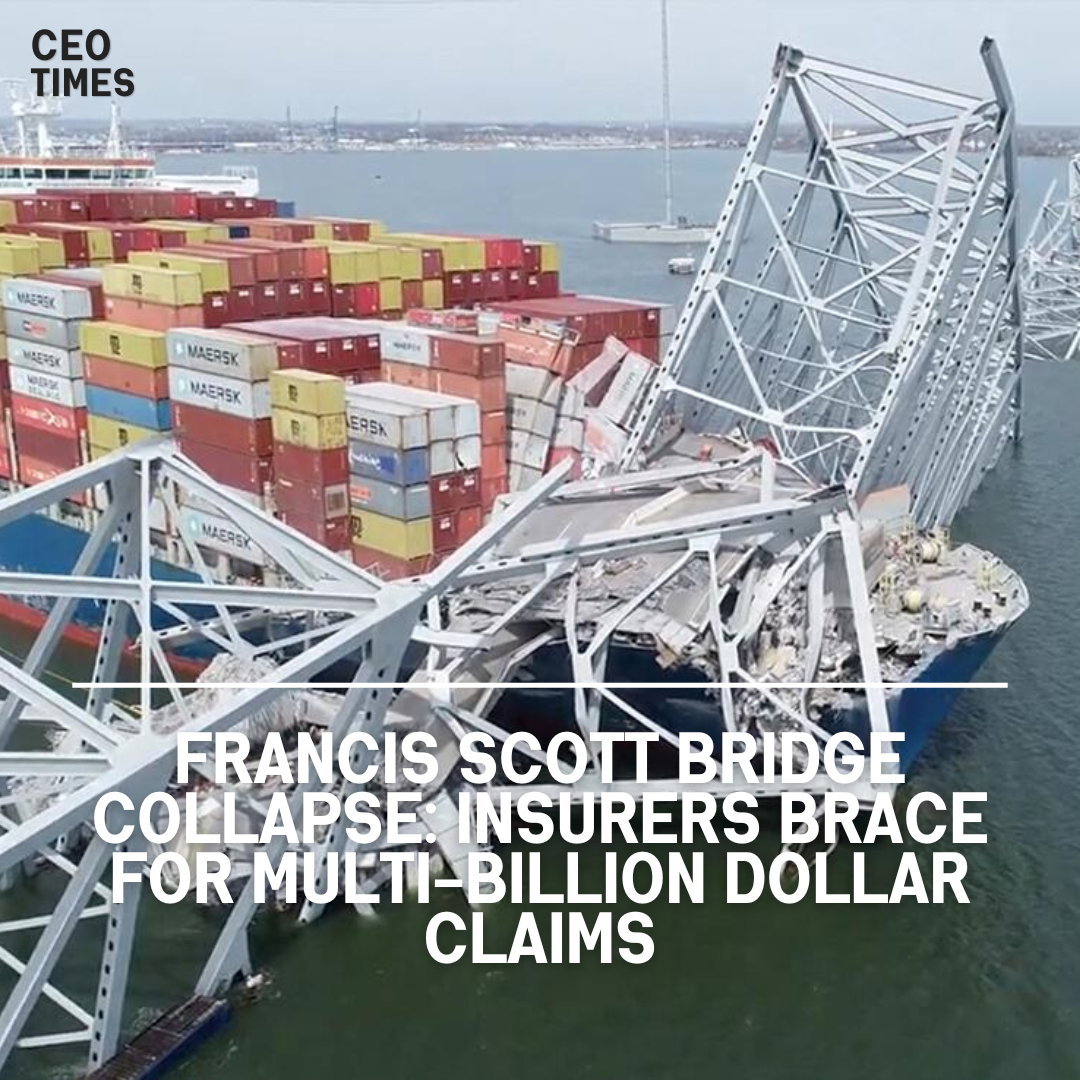

The collapse of Baltimore’s Francis Scott Key Bridge following a collision with a container ship has triggered significant repercussions, including potential multi-billion dollar losses for insurers.

As search efforts continue for six missing individuals, the closure of the Port of Baltimore has halted crucial maritime operations, sparking concerns across the insurance industry.

Assessing the Financial Fallout:

Insurers and analysts are grappling with the complex task of estimating the financial impact of the bridge collapse, encompassing various product lines such as property, cargo, marine, liability, and more.

The absence of clarity regarding the port’s reopening adds to the challenge of quantifying the full extent of the losses.

Ship Liability Insurance Implications:

Ship liability insurance, provided by protection and indemnity insurers, plays a crucial role in addressing marine environmental damage and injury claims.

The International Group of P&I Clubs, which insures a significant portion of the world’s ocean-going tonnage, faces potential claims that could surpass the $3.1 billion threshold covered by general excess of loss reinsurance.

Reinsurance Dynamics:

The dispersion of the anticipated claim burden across approximately 80 different reinsurers mitigates the potential impact on individual reinsurers.

While the overall claim size is expected to be substantial, the widespread distribution among reinsurers helps dampen the financial strain on any single entity.

Economic Ramifications:

Beyond insurance considerations, the economic fallout from the bridge collapse looms large. Initial estimates suggest a hefty price tag for rebuilding the bridge, with federal government involvement likely.

Moreover, the closure of the port could lead to significant economic losses for the state of Maryland, amplifying the ripple effects felt by businesses and individuals in the region.