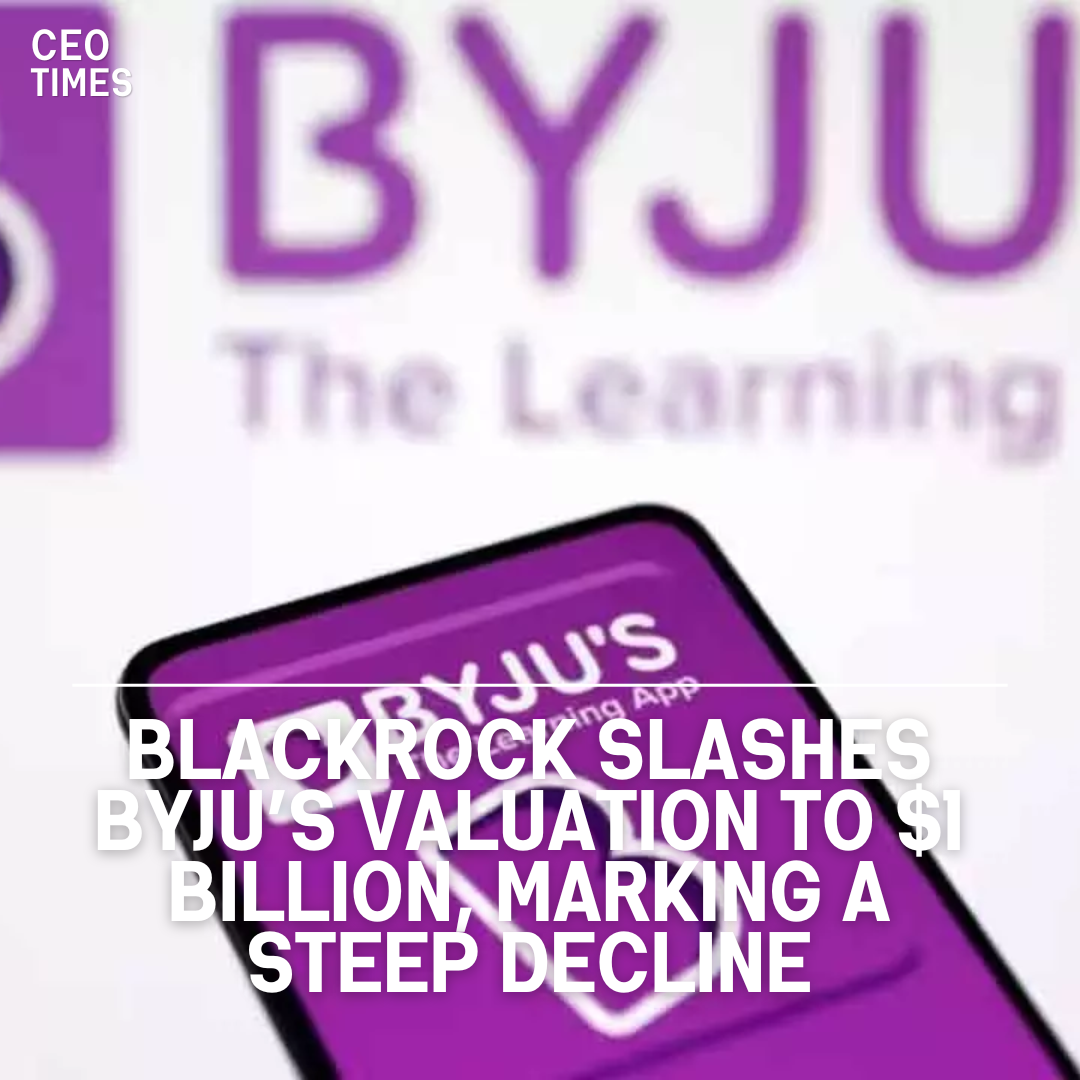

BlackRock has significantly reduced the valuation of its holding in Indian edtech startup Byju’s, marking a drastic decline from $22 billion in early 2022 to approximately $1 billion, according to disclosures made by the asset manager.

The valuation markdown reflects a series of challenges faced by Byju’s, including financial struggles, missed revenue targets, and postponed IPO plans.

Valuation Adjustment Reflects Ongoing Downward Trend:

BlackRock, which owns less than 1% of Byju’s, disclosed a valuation of about $209.6 per share for Byju’s at the end of October 2023.

This implies a valuation of $990 million, showcasing a sharp drop from the peak valuation of $22 billion in 2022.

The asset manager has previously made valuation adjustments for its Byju’s holding, but the latest adjustment is notably more drastic.

Byju’s Struggles Amid Financial Challenges and Investor Criticism:

Byju’s, once considered India’s most valuable startup at $22 billion, has faced a challenging period marked by financial difficulties, missed targets, and postponed IPO plans.

Prosus, another major investor in Byju’s, had previously stated that it valued the edtech firm at “sub $3 billion.” Byju’s, which aimed to go public in early 2022, had to defer its IPO plans due to market uncertainties triggered by Russia’s invasion of Ukraine.

Reversal of Fortune for Byju’s:

The steep valuation markdown by BlackRock reflects a significant reversal of fortune for Byju’s, which was once celebrated as a prominent player in the Indian startup ecosystem.

The startup had garnered attention and high valuations, reaching up to $50 billion, while engaging in a series of acquisitions globally.

However, it now grapples with investor concerns, financial pressures, and challenges to meet business expectations.