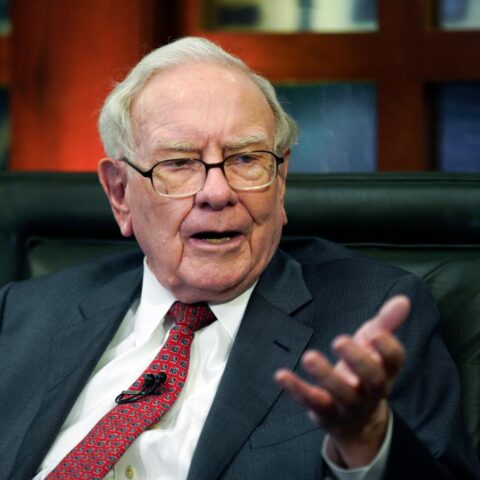

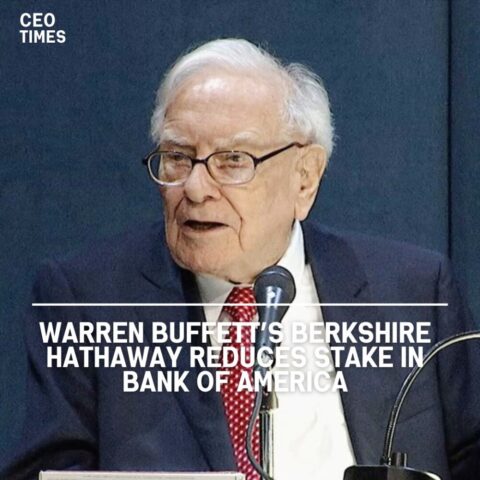

As Warren Buffett prepares to step down, Berkshire posts weaker results across key sectors, grapples with losses from Kraft Heinz, and flags economic headwinds from global tariffs and trade policy shifts.

Omaha, NE – August 3, 2025 — In its first earnings report following Warren Buffett’s announcement that he will step down as CEO, Berkshire Hathaway revealed a 3.79% drop in operating earnings for the second quarter, reflecting ongoing economic pressures and a challenging investment landscape.

The conglomerate reported $11.16 billion in Q2 operating earnings, down from $11.6 billion during the same period in 2024. For the first half of the year, operating earnings totaled $20.8 billion, representing an 8.8% decrease year-over-year.

Meanwhile, net income for the second quarter plunged to approximately $12.37 billion, marking a staggering 59% decline compared to last year’s second-quarter results.

This performance arrives at a pivotal moment for Berkshire. Warren Buffett, now 94, announced earlier this year that he will step down as chief executive by year-end, naming Greg Abel, vice chairman of non-insurance operations, as his successor.

Sector Performance: Strength in Rail and Energy, Weakness in Insurance and Consumer Brands

Berkshire’s insurance underwriting business—a traditional profit engine—saw a pre-tax earnings decline of nearly 11%, reporting $2.53 billion, compared to $2.84 billion a year earlier.

On the other hand, energy and transportation divisions delivered more optimistic figures. BNSF Railway reported an 11.5% rise in pre-tax earnings, while Berkshire Hathaway Energy (BHE) saw net income climb 18%, underscoring the company’s diversification across infrastructure assets.

However, consumer-facing subsidiaries faced major hurdles. Fruit of the Loom, Garan, and Jazwares—Berkshire-owned apparel and toy companies—reported significant year-to-date revenue declines of 11.7%, 10.1%, and 38.5%, respectively. The company attributed these setbacks to ongoing disruptions from global trade policy and tariffs, which have resulted in shipment delays and sluggish order volumes.

Kraft Heinz Woes and Cash Reserve Shifts

Berkshire also disclosed a $3.8 billion loss on its investment in Kraft Heinz Co., a company Buffett once admitted he misjudged. In 2019, he told CNBC, “I was wrong in a couple ways on Kraft Heinz.” The latest write-down highlights lingering challenges in the packaged food sector, which has faced changing consumer preferences and margin pressures.

The company’s formidable cash reserves also saw a modest dip. As of July, Berkshire held $344 billion, slightly down from the $347 billion reported at its annual shareholder meeting in May.

Trade Tensions Cloud Outlook

In a cautionary note, Berkshire cited increasing economic uncertainty linked to President Donald Trump’s escalating trade policies, including newly announced tariffs set to take effect on August 7.

“We are currently unable to reliably predict the nature, timing or magnitude of the potential economic consequences of any such changes,” the company stated in its earnings report.

Trump’s trade stance has introduced volatility across several Berkshire holdings and operating companies, as global supply chains face heightened disruption.

As the Buffett era draws to a close, Berkshire Hathaway is clearly navigating a complex economic landscape. While the company’s deep cash reserves and diverse holdings provide a cushion, its latest results underline the challenges facing Abel as he prepares to lead one of the world’s most closely watched conglomerates into a new chapter.