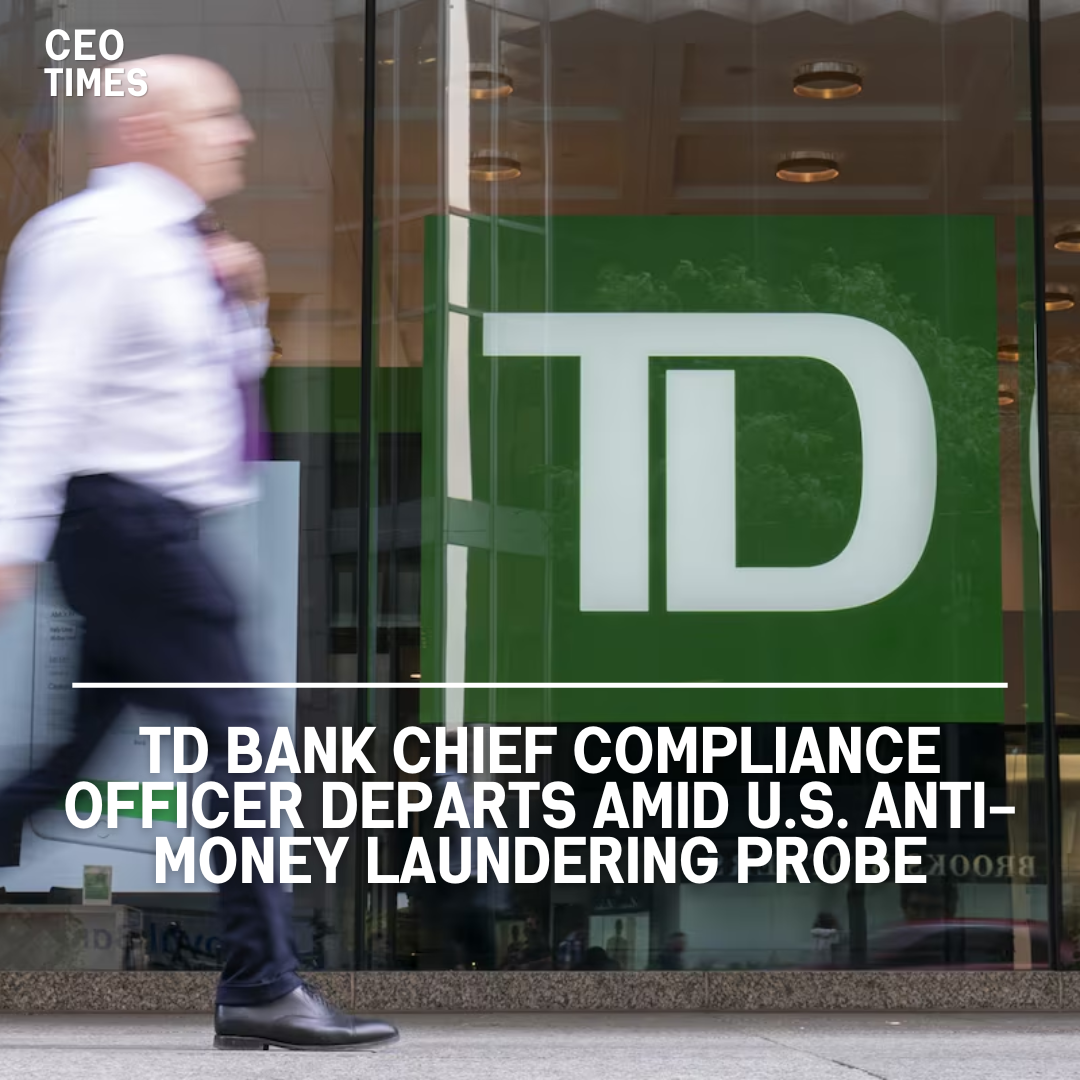

Monica Kowal, TD Bank’s chief compliance officer since 2017, has left the company amidst ongoing scrutiny from U.S. regulators and the Justice Department regarding its anti-money laundering (AML) practices.

Internal Memo Details:

Reuters saw an internal memo announcing Kowal’s departure this week. Erin Morrow, previously Deputy Chief Compliance Officer, will assume the role and report to Chief Risk Officer Ajai Bambawale.

The memo did not specify the reasons for Kowal’s departure. TD CEO Bharat Masrani has previously emphasized the bank’s accountability, taking actions against responsible employees, including terminations.

Response and New Leadership:

TD declined to comment on Kowal’s departure. Morrow, who joined TD in January after a tenure at Citi, is part of TD’s efforts to strengthen its compliance team. Marcy Forman, Jacqueline Sanjuas from Citi, and Herbert Mazariegos from BMO have also been hired to enhance the regulatory program.

TD has invested over $500 million in training programs, hiring AML professionals, and appointing new executives following Masrani’s acknowledgment of deficiencies in its AML program. The bank aims to address shortcomings in monitoring, detection, reporting, and response.

Financial Provisions and Penalties:

The bank has set aside an initial provision of $450 million and anticipates further monetary penalties. Analysts suggest fines could amount to $4 billion, reflecting the severity of the regulatory issues.