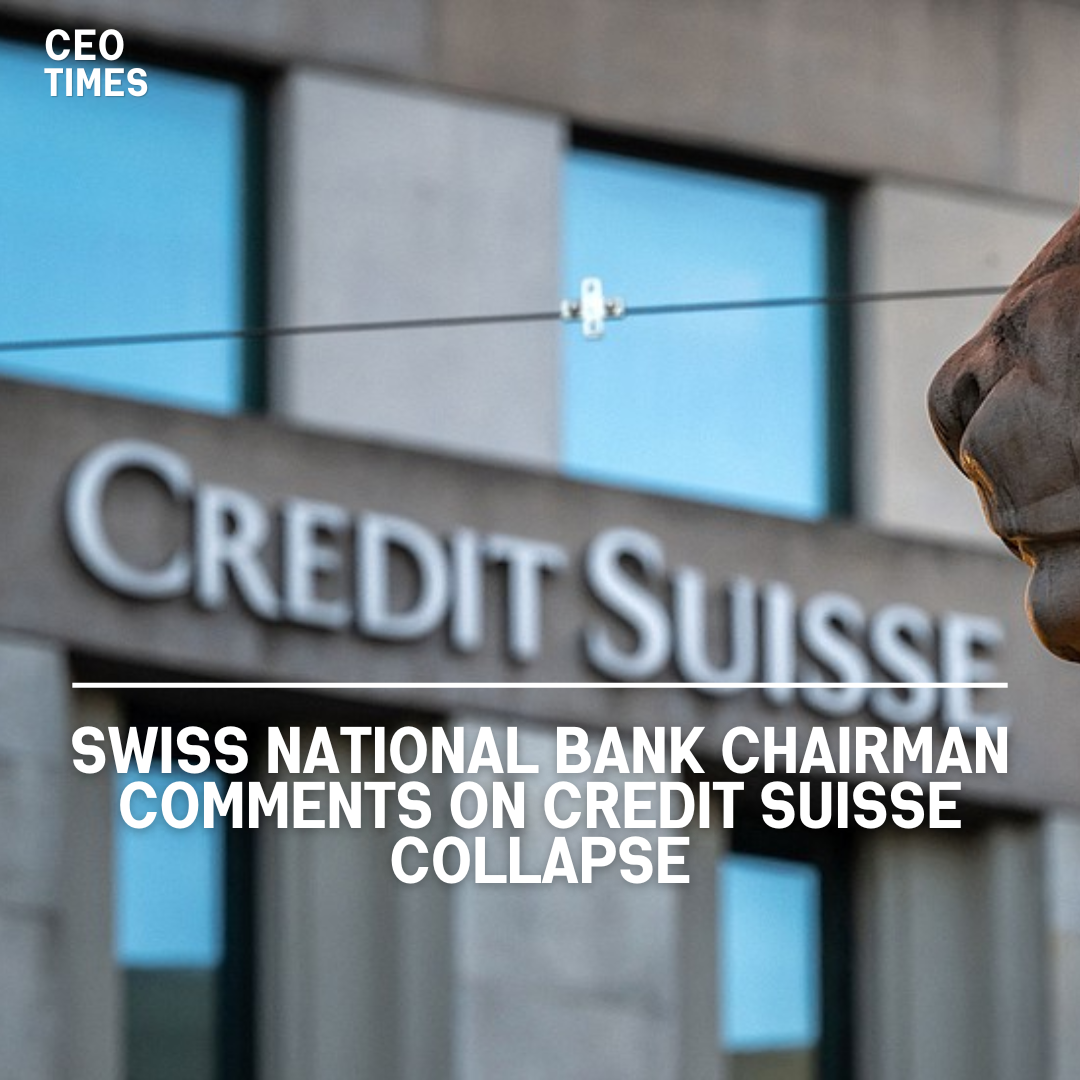

Swiss National Bank (SNB) Chairman Thomas Jordan attributes Credit Suisse’s collapse to management’s poor decisions rather than the failures of Swiss financial authorities, emphasizing that necessary measures were taken to prevent a global financial crisis.

State-Brokered Takeover by UBS:

Jordan supports the state-brokered takeover of Credit Suisse by UBS last year as the best available option. He highlights the limits of SNB intervention in bank rescues, which he believes is a decision for politicians involving public funds.

Acknowledging the need for improved banking regulations, Jordan stresses that drawing up regulations involves SNB, government, and financial market regulator FINMA. He supports proposed measures, including stricter capital requirements for systemically relevant banks.

Importance of Capital Requirements:

Jordan underscores the importance of calculating equity capital requirements realistically to ensure banks can absorb losses during crises. He also emphasizes the need for banks to maintain adequate assets as collateral for emergency liquidity support.

Jordan advocates for a credible resolution framework where banks can be orderly wound down or restructured without destabilizing the financial system or economy.

Monetary Policy and Inflation Outlook:

Regarding monetary policy, Jordan states that while interest rates remain the SNB’s primary tool, the bank is prepared to intervene in foreign currency markets as needed. He is relaxed towards inflation, forecasting it to be around 1% in the medium term.