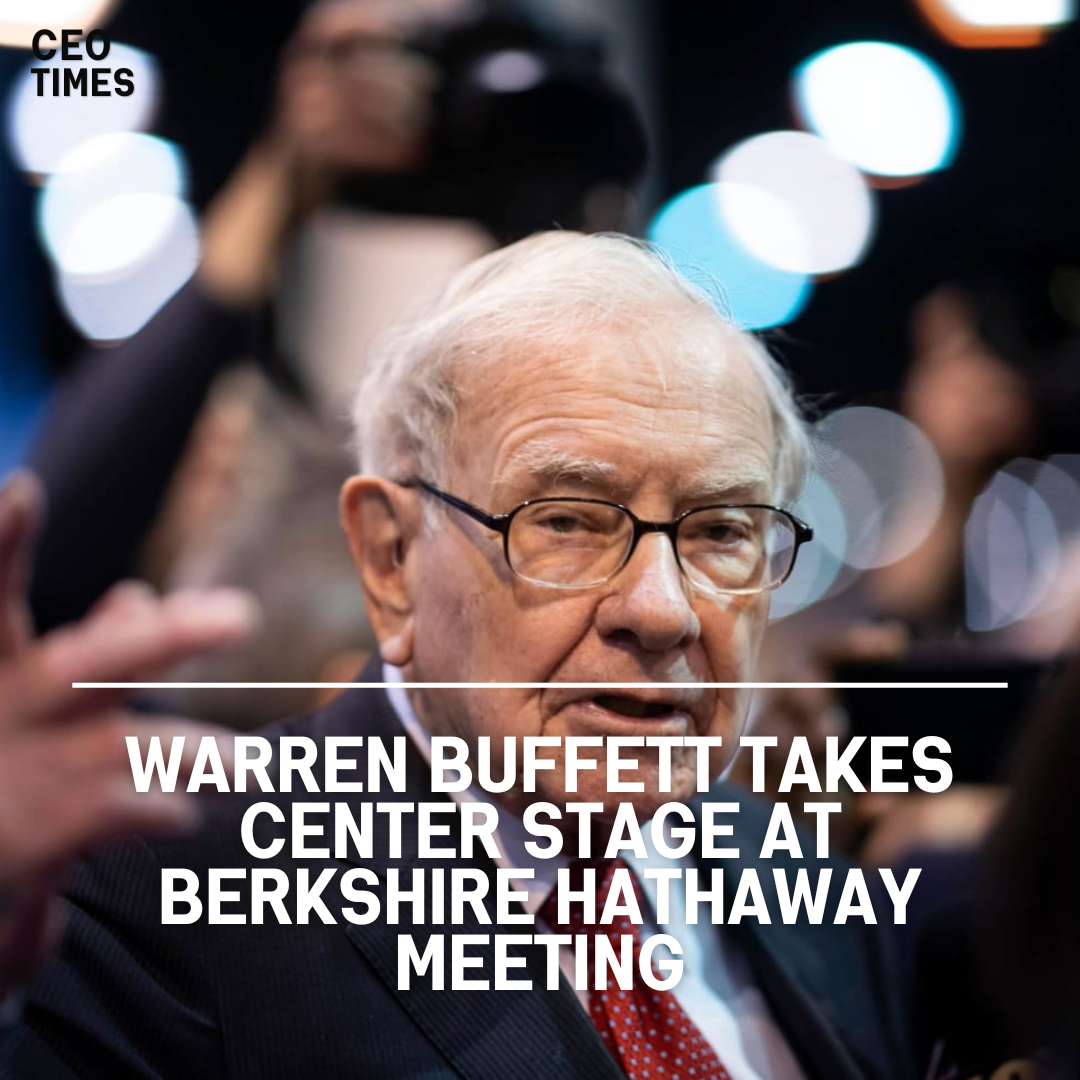

Warren Buffett presided over Berkshire Hathaway’s milestone 60th annual shareholder meeting, which provided investors with valuable insights into the company’s future direction and strategic decisions.

Succession Planning and Leadership Transition:

With Vice Chairman Greg Abel identified as Buffett’s successor, investors seek clarity on Berkshire’s leadership transition and Abel’s vision for the conglomerate’s growth trajectory.

Berkshire faces challenges deploying its significant cash reserves of $167.6 billion while maintaining prudent investment strategies and avoiding overpayment for acquisitions.

Managing Expectations in a Maturing Market:

Buffett acknowledges the limitations posed by Berkshire’s size, emphasizing the need for realistic growth expectations amid market dynamics and economic uncertainties.

The meeting marks the first without Charlie Munger, Buffett’s longtime confidant and partner, prompting reflections on his significant contributions and distinctive presence at past meetings.

Investors and attendees anticipate Buffett’s insights and responses to inquiries, recognizing the meeting’s importance in shaping Berkshire’s future trajectory and addressing shareholder concerns.